Polymarket allows users to bet on the future using blockchain technology. As the platform continues its rapid growth – surpassing $13 billion in trading volume by early 2025, it’s redefining how markets can harness collective intelligence. This article explores how Polymarket works, the mechanics behind its markets, and why it’s becoming a focal point for both traders and crypto-native forecasters alike.

What Is Polymarket?

Polymarket is a decentralized prediction market that allows users to speculate on real-world events – from elections and sports to macroeconomic indicators, by buying and selling outcome shares. Built initially on the Polygon network and now expanding to Solana, the platform leverages smart contracts and oracles to facilitate trustless, transparent trading without requiring KYC.

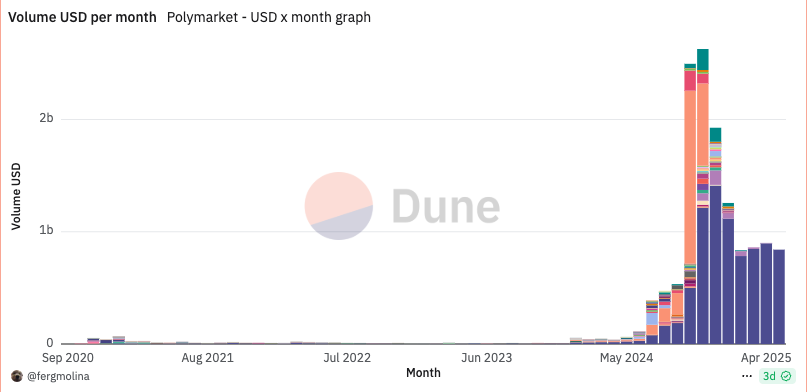

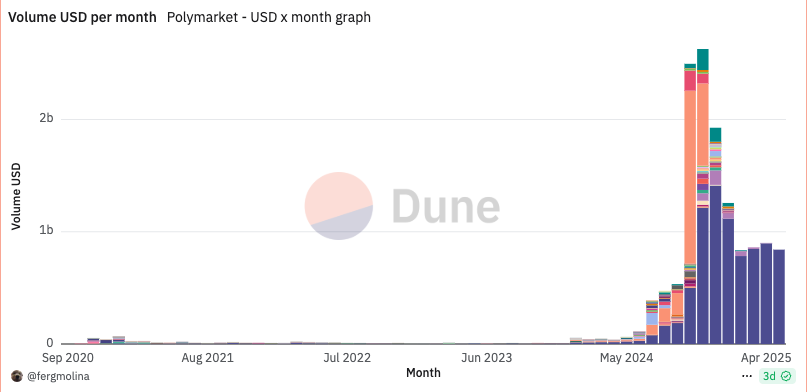

The platform’s rise has been rapid. By March 2025, it had processed over $13.25 billion in cumulative trading volume. Monthly active users peaked at 450,000 in January, up 91% from just a few months prior.

Source: Dune

This growth was fueled in part by its expansion to Solana, which lowered transaction fees and improved user experience. Despite November 2024 remaining its highest-volume month to date – at $2.63 billion, ongoing user onboarding and market diversity suggest Polymarket’s momentum remains strong.

This combination of transparency, market liquidity, and speculative appeal has made Polymarket a leading force in decentralized information markets.

The Basics of Prediction Markets

Before diving into Polymarket specifically, it’s important to understand what a prediction market is. In essence, a prediction market is a marketplace where participants can trade shares representing the possible outcomes of an event.

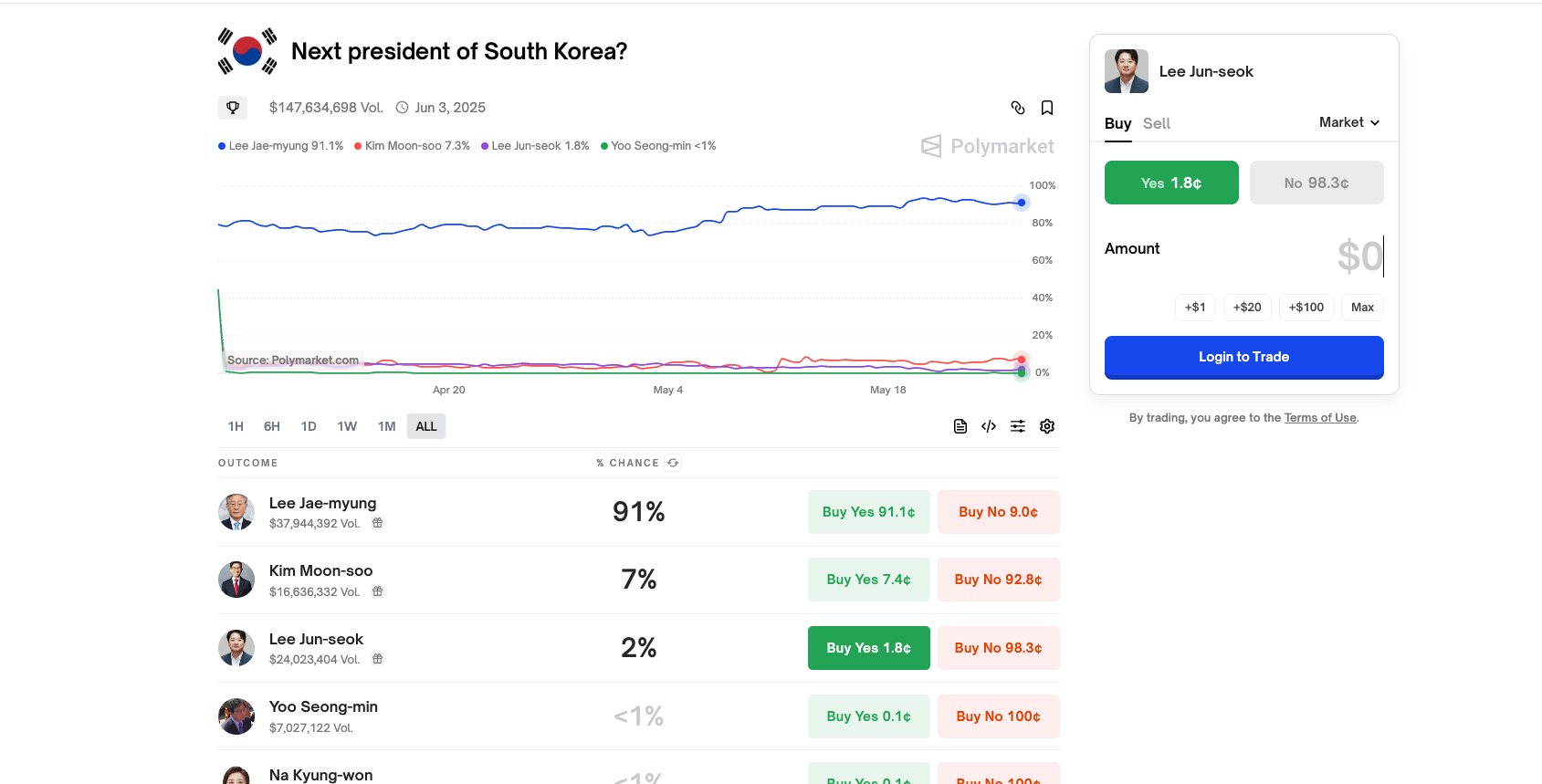

The price of each share reflects the collective belief of traders about the probability of a particular outcome. For example, if a share representing “Candidate A wins the election” is trading at $0.70, the market is suggesting a 70% chance of that outcome.

Prediction markets are often lauded for their ability to aggregate information more efficiently than traditional polls or expert analyses. Because participants have financial incentives to be accurate, these markets tend to reflect the best available information about future events.

Market Structure and Trading Mechanism

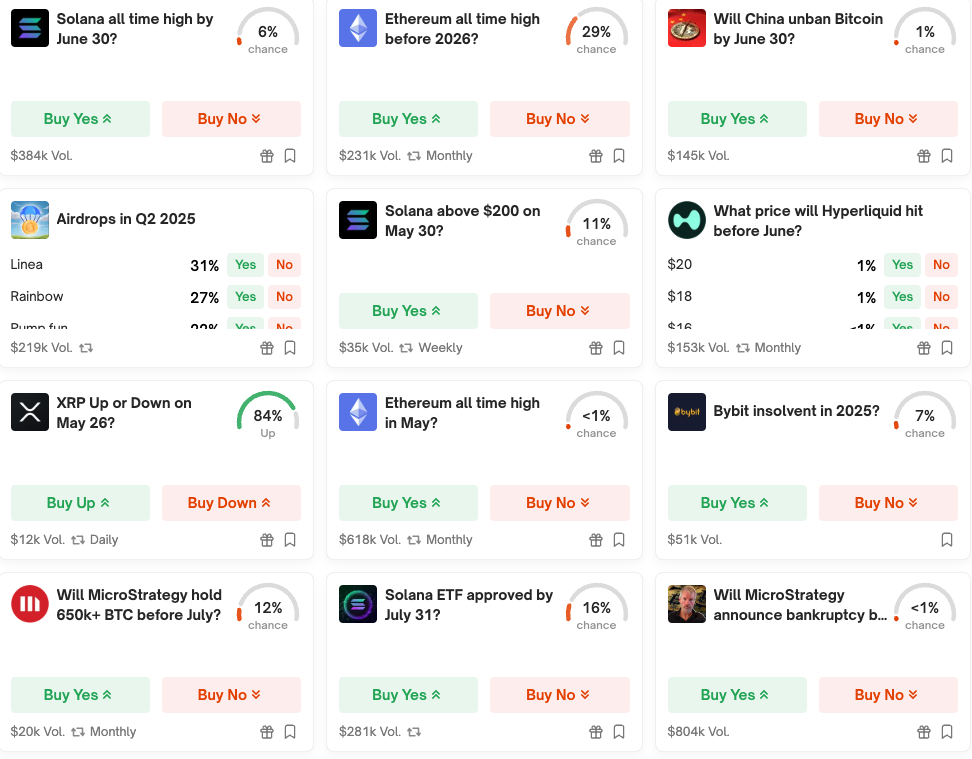

Polymarket supports both binary and scalar markets, each catering to different types of event predictions:

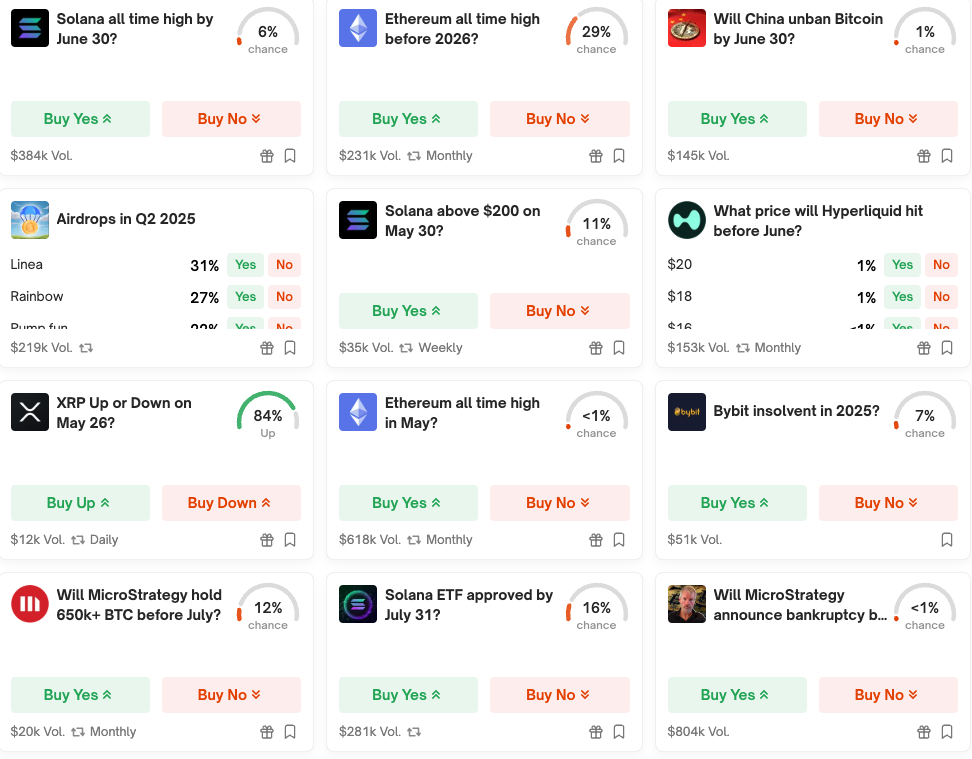

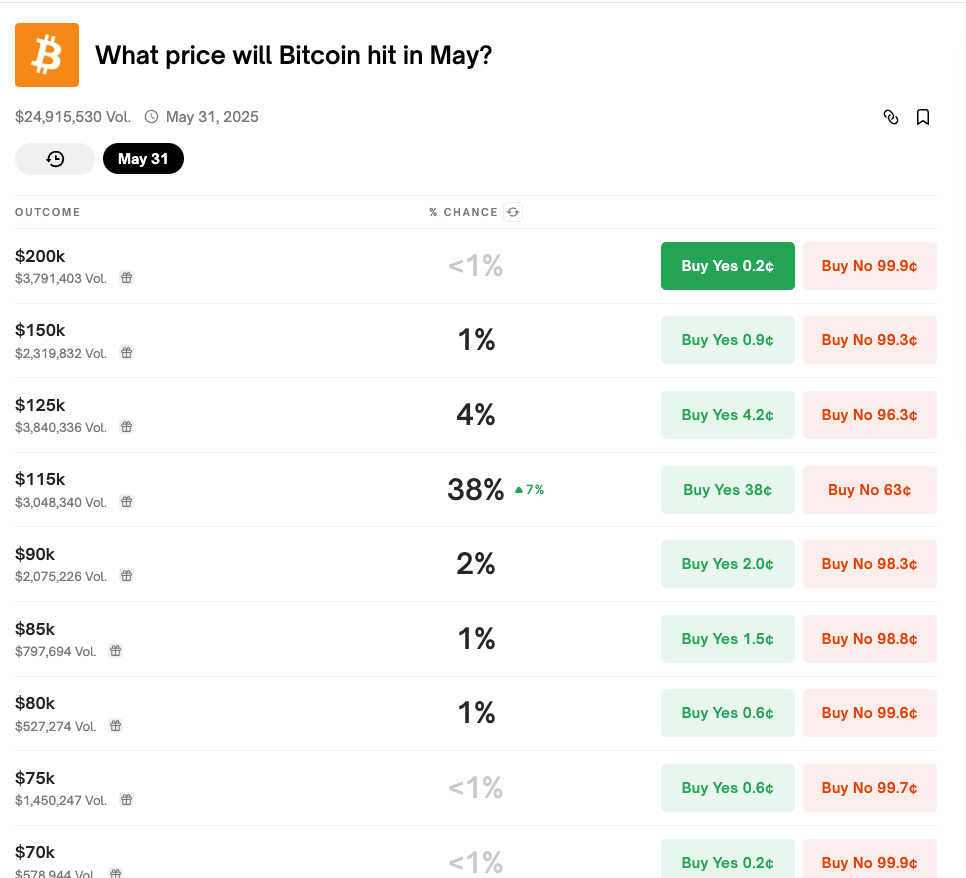

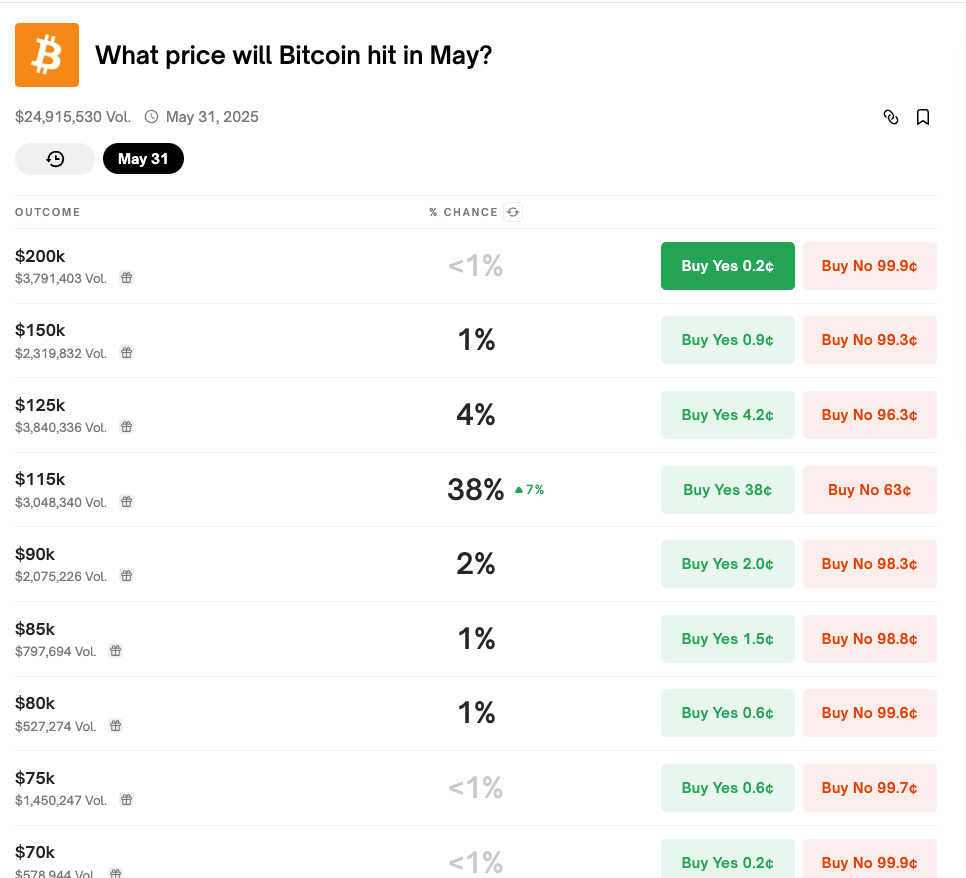

- Binary Markets: These are the most common and straightforward. Each market has two possible outcomes – “Yes” or “No”. Users can buy shares in either outcome, and if they are correct, each winning share will be worth $1 upon market resolution.

Example: Will Bitcoin be above $130,000 on June 30? The two outcomes are “Yes” and “No”. If you buy a “Yes” share at $0.65, you’re expecting a 65% chance that this happens. If correct, you earn $1 per share; if incorrect, you lose your stake.

- Scalar Markets: These markets allow traders to bet on a numerical outcome across a range. Instead of a simple Yes/No, users can take positions on variables such as inflation rates, unemployment figures, or temperature forecasts.

Example: What will the CPI inflation rate be for May 2025? Options may include ranges like 3.0%–3.4%, 3.5%–3.9%, etc. Each range is treated as a separate outcome, and the correct range will resolve to $1.

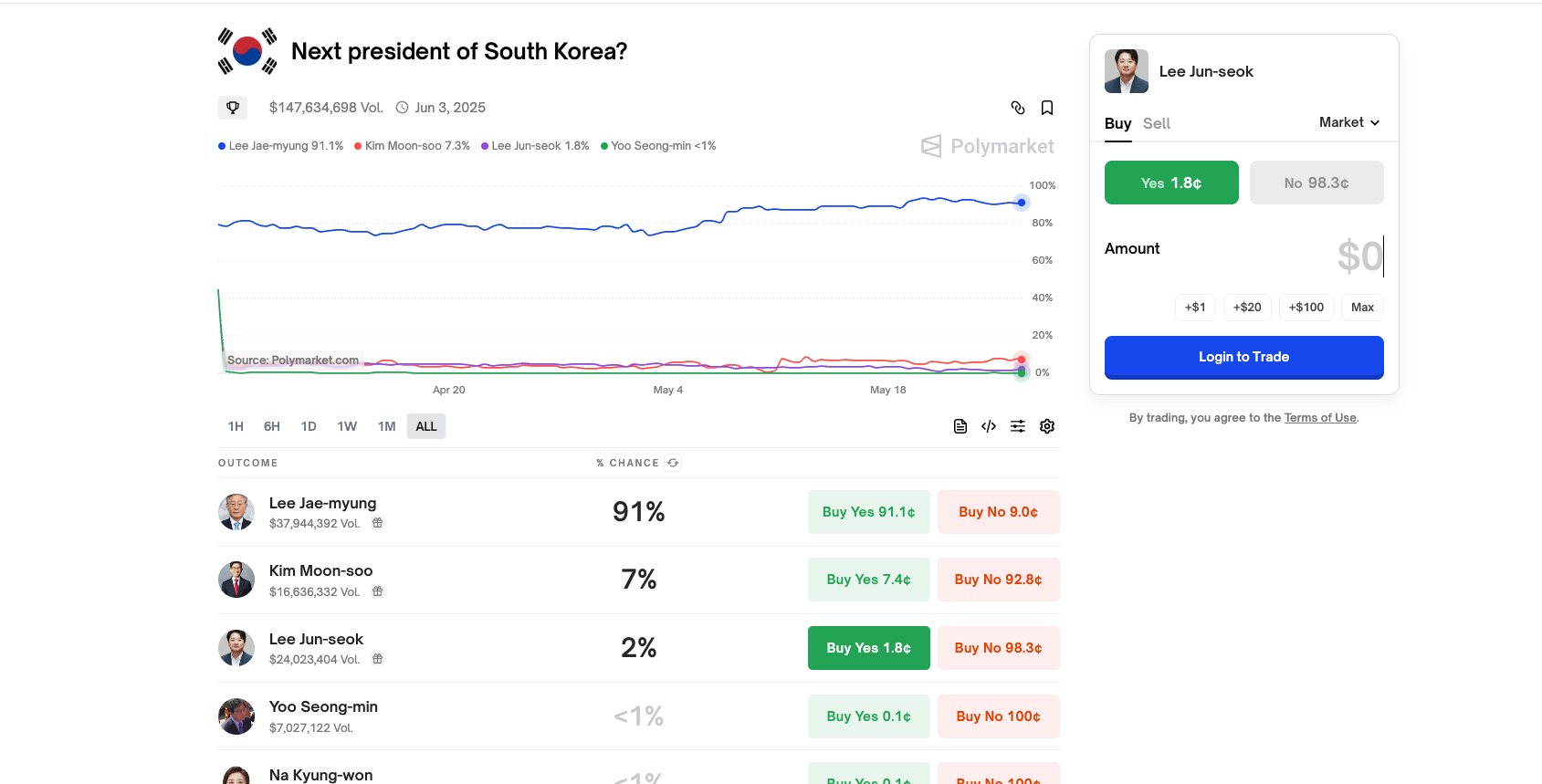

- Multi-outcome Markets: Some events have more than two possibilities. These often include political primaries (e.g., “Who will win the Republican nomination?”) or award shows (“Who will win Best Picture?”).

Users can buy shares in one or more candidates/outcomes. The total price of all outcomes might not sum to $1, creating arbitrage opportunities.

All trading on Polymarket is done using USDC, a stablecoin pegged to the U.S. dollar. This provides price stability and avoids crypto volatility.

Markets remain open until the event in question occurs or becomes logically determined (e.g., a team mathematically eliminated from a tournament).

Trades are executed via automated market makers (AMMs), which means:

- Prices adjust based on the demand for each outcome.

- The more people buy “Yes”, the higher its price becomes.

- AMMs ensure constant liquidity, allowing users to enter and exit positions at any time.

The system avoids order books and counterparty matching, making it fast and permissionless.

Once an event concludes, the outcome is verified through a decentralized oracle, and:

- Winning shares are redeemable for $1.

- Losing shares become worthless.

- Users can withdraw their USDC or reinvest in other markets.

By combining flexible market types, real-time pricing, and decentralized settlement, Polymarket offers a robust infrastructure for forecasting events across domains – from politics and economics to sports and pop culture.

Fees and Incentives

Polymarket charges a small fee on trades, which helps fund platform development and oracle costs. Unlike traditional bookmakers or centralized prediction platforms, Polymarket does not take a spread or act as a counterparty to trades. This means users are essentially betting against each other, with the platform merely facilitating the transaction.

Incentives also come in the form of liquidity mining campaigns and trading competitions, which Polymarket has employed in the past to bootstrap user activity and reward engagement. These incentives help ensure there is enough volume and open interest in key markets, particularly around high-profile events.

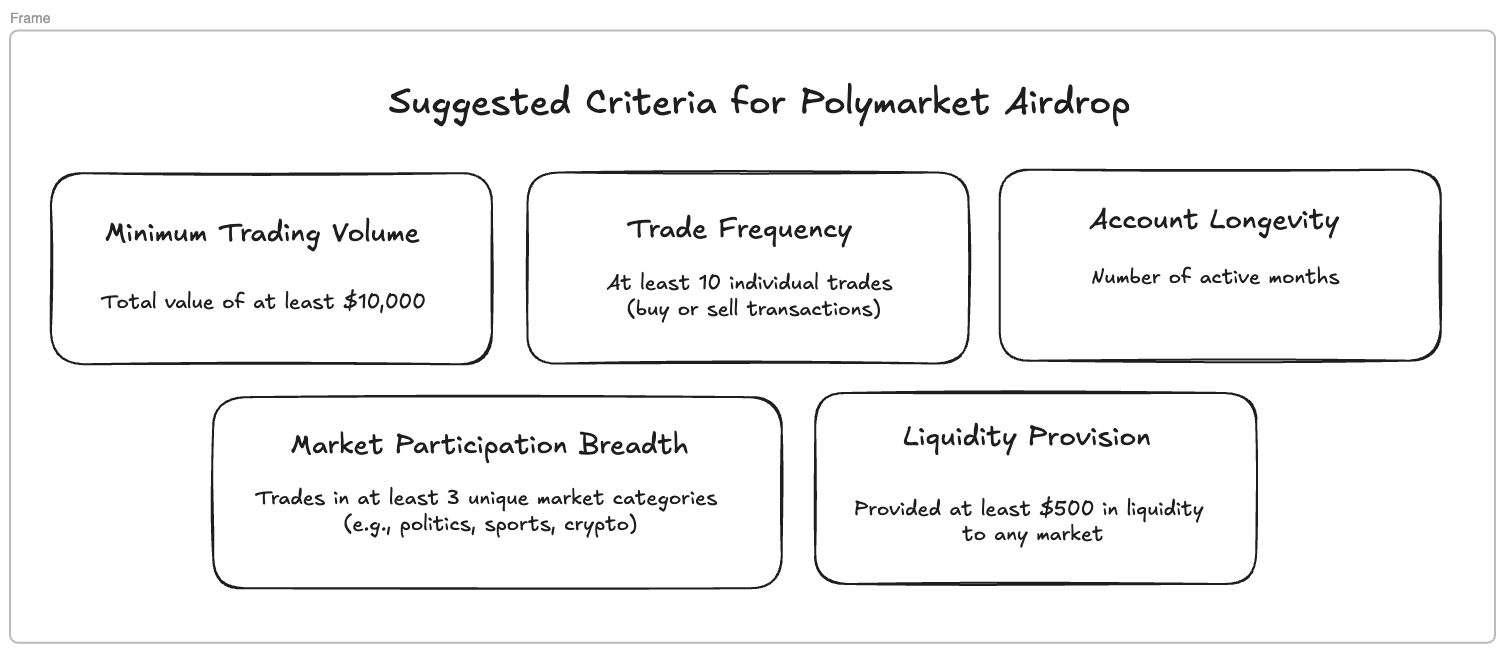

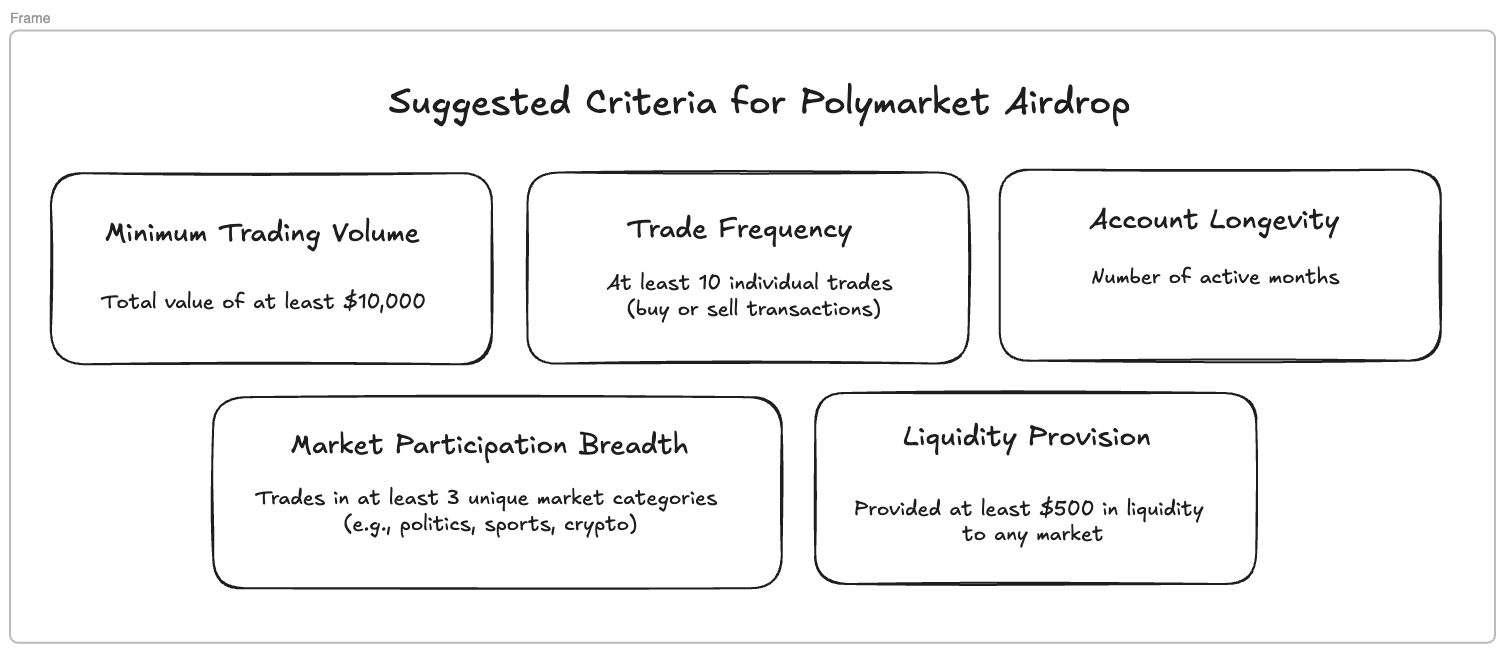

Importantly, there is also growing speculation that Polymarket may launch a native token in the near future. While no official announcement has been made, many industry observers believe that on-chain activity such as placing trades, providing liquidity, or engaging with high-volume markets – could be retroactively rewarded through an airdrop.

Users who are early and active participants on the platform may therefore benefit not only from trading profits, but also from potential future token allocations. This possibility has further contributed to Polymarket’s growing user base and trading volume.

Polymarket’s Infrastructure

Polymarket is built on Polygon, a Layer 2 scaling solution for Ethereum. This enables low-cost, high-speed transactions, which are essential for frequent trading and liquidity in prediction markets. The use of blockchain also means that all market activity is transparent and verifiable by anyone, helping to ensure integrity and trust in the platform.

Users interact with Polymarket through a web-based interface where they can browse open markets, place trades, and monitor their portfolios.

The platform does not require users to complete KYC (Know Your Customer) checks, making it accessible to a global audience while also reinforcing its censorship-resistant ethos. However, due to regulatory restrictions, users in the United States are currently barred from participating.

Resolution and Oracles

A critical component of any prediction market is the resolution process. That is, how the platform determines the actual outcome of an event. In Polymarket’s case, resolution is managed by an independent oracle system called UMA’s Optimistic Oracle. After an event concludes, the platform submits the outcome data to the oracle. If no one disputes it within the designated time window, the result becomes final.

The use of UMA’s oracle provides a decentralized and tamper-resistant way to determine outcomes. However, if a dispute arises – say, someone challenges the accuracy of the result, the system enters a dispute resolution phase, where token holders can stake and vote to resolve the conflict. This mechanism ensures integrity while minimizing central points of failure.

Tips and Strategies for Using Polymarket Effectively

To make the most of Polymarket, users can benefit from understanding a few advanced tips and strategic approaches that seasoned traders often employ:

One useful tactic is identifying markets with multiple options or fragmented liquidity, especially in non-binary markets. When a market has more than two outcomes (e.g., “Who will win the Republican nomination?”), the prices may not always add up to $1.

This opens up arbitrage opportunities. Traders can buy underpriced shares across all options if the total is less than $1 or sell shares if they sum to more than $1, locking in a guaranteed profit when the market resolves.

Another strategic insight involves timing trades based on public sentiment swings. Polymarket markets often react in real-time to breaking news or viral social media moments. Traders who can anticipate shifts in sentiment, or who are quick to act on new information can buy shares before the market adjusts.

Read more: What is InfoFI? How to Make Money with InfoFi

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Wrapped SOL

Wrapped SOL  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Wrapped Bitcoin

Wrapped Bitcoin  Monero

Monero  Wrapped eETH

Wrapped eETH  Chainlink

Chainlink  USDS

USDS  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  WETH

WETH  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Stellar

Stellar  Zcash

Zcash  Sui

Sui  Ethena USDe

Ethena USDe  Hyperliquid

Hyperliquid  Avalanche

Avalanche  Litecoin

Litecoin  Hedera

Hedera  Shiba Inu

Shiba Inu  Canton

Canton  USDT0

USDT0  World Liberty Financial

World Liberty Financial  Dai

Dai  Toncoin

Toncoin  Cronos

Cronos  sUSDS

sUSDS  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Polkadot

Polkadot  USD1

USD1  Uniswap

Uniswap  Rain

Rain  Mantle

Mantle  MemeCore

MemeCore  Bittensor

Bittensor