What is StakeStone? StakeStone is an omnichain liquidity protocol designed to streamline staking and improve capital efficiency in DeFi. Users can stake various tokens such as ETH, STONE, and SBTC. The platform features a developer hub for collaboration and uses smart contracts to automate processes.

Dive into this article to learn more about what StakeStone is, its unique features, mission, and benefits, as well as the STO Token.

StakeStone Overview

StakeStone represents a pioneering protocol in the realm of omnichain liquidity that aims to improve staking processes and increase capital efficiency across the DeFi landscape. StakeStone provides users with an array of options, enabling them to stake different tokens, such as STONE and SBTC, according to their asset preferences, offering adaptability within its ecosystem.

When engaging in ETH staking, participants have the liberty to choose from a suite of assets, including STONE and SBTC, for enhanced customization of their staking endeavors.

A significant aspect contributing to StakeStone’s distinction is its developer-friendly hub, which nurtures collaborative efforts among coders. This collective space actively supports developers in crafting yield-bearing assets utilizing APIs alongside smart contracts—thereby driving innovation while broadening the scope for constructing additional yield-generating instruments within the protocol.

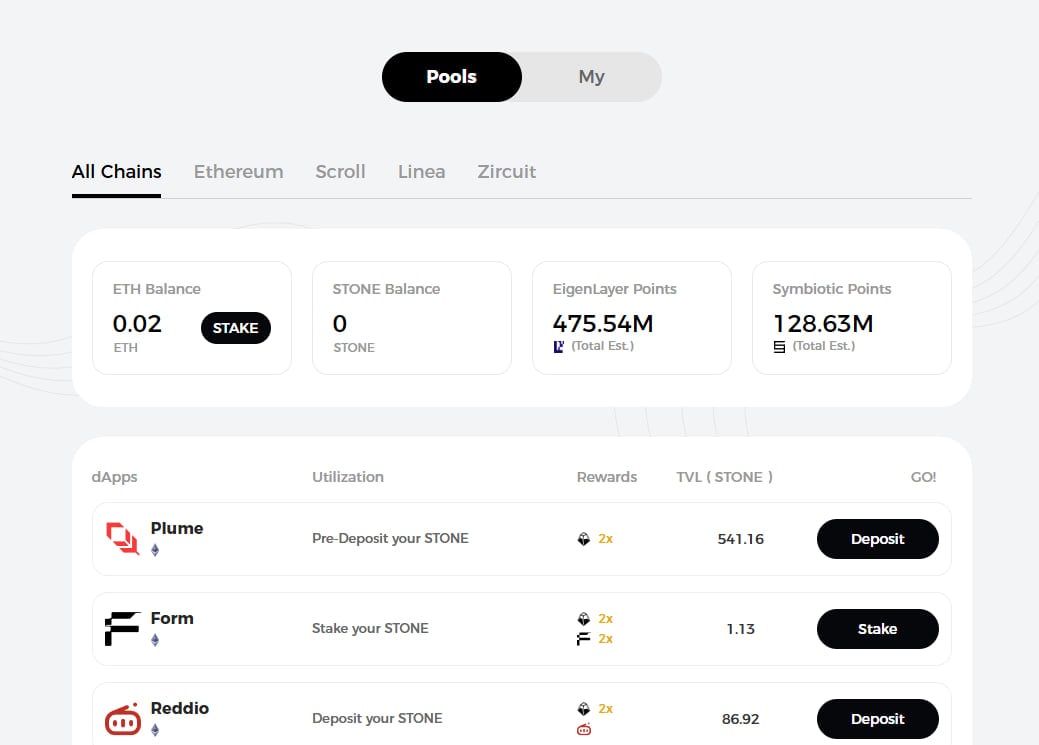

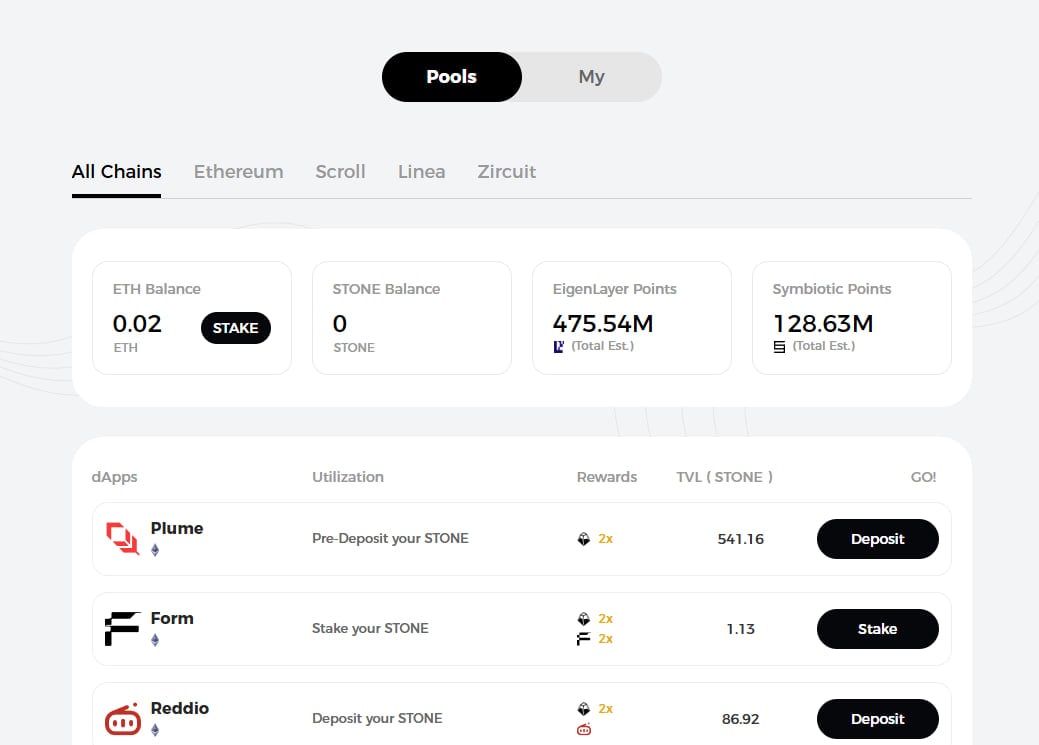

Source: StakeStone

The degree of confidence vested in this system can be measured through both funding milestones achieved as well as sizable metrics representing committed funds held under lock and key within its framework.

As reported by Cryptofundraising sources, a striking $23M has been secured via various investment drives led notably by YZI Labs, Polychain Capital, and OKX Ventures, exhibiting steadfast investor conviction behind StakeStone’s potential.

StakeStone has partnered with 100+ different units

Insightful data extracted from Dune Analytics underscores that there exists approximately $532 million cemented into Total Value Locked (TVL) status inside the comprehensive confines offered by Stakestone. This figure serves not just as a testament but also reinforces the concretely established trustworthiness patronized amongst members constituting DeFi networks at large.

Learn more: Binance Lists StakeStone (STO) on HODLer Airdrops!

StakeStone’s Mission and Vision

StakeStone is dedicated to transforming the way liquidity is distributed within the Decosystem with an eye towards efficiency and sustainability. The initiative focuses on unleashing the untapped potential of liquid assets to foster seamless and efficient capital movement throughout various ecosystems. Central to this objective is StakeStone’s native $STO token, which underpins their omnichain liquidity infrastructure and empowers its governance framework.

With a two-year track record of refining its omnichain liquidity solutions, StakeStone demonstrates unwavering innovation, shaping a flexible staking network tailored for the dynamic requirements of the DeFi sector. Liquidity providers who engage with StakeStone can enhance their returns by committing veSTO tokens, thus intertwining their rewards with the protocol’s enduring prosperity.

Positioning itself as both effective and accessible, stakestone strives to establish a cutting-edge yet inclusive landscape for managing liquidity. Through harnessing advanced technologies alongside collective input from stakeholders within its community-driven design ethos, it stands poised as an influential force intent on redefining participation in decentralized finance environments while amplifying overall access to liquid assets across multiple spaces.

The Benefits of Using StakeStone

Utilizing StakeStone comes with the key advantage of providing liquid, yield-bearing forms of ETH and BTC referred to as STONE tokens. These tokens enable users to generate returns while retaining their assets’ liquidity, thereby increasing capital efficiency. As a result, users can ensure that their stone assets remain fluid for various endeavors without forfeiting the opportunity to gain compelling yields.

StakeStone enhances how liquidity is dispersed across different blockchain ecosystems by dynamically channeling funds where they are most needed. This omnichain strategy promotes optimal return on investments through improved yield generation capabilities. The protocol’s straightforward interface makes staking accessible even for novices in the field, offering flexibility in withdrawals and real-time monitoring of one’s earnings, all contributing to an effortless asset management process.

With its adaptive staking network, StakeStone streamlines earning potential from yields right from the initiation steps. Its user-friendly design guides people easily through all the steps of staking, making the process simple and effective—this allows quick access to appealing yield opportunities and real-time tracking features, keeping participants engaged by letting them monitor their investment results continuously.

In essence, utilizing stakestone transcends mere profit-earning advantages. It provides a complete resource aimed at improving liquidity strategies while also enhancing capital efficiency and encouraging active user involvement—a significant tool for those looking to engage effectively in DeFi areas.

StakeStone Key Features

StakeStone simplifies the complex challenges of liquidity management and user acquisition that protocols and chains often face. By leveraging liquid assets, these blockchain ecosystems can more easily bootstrap liquidity and attract users, creating a more organic, robust, and sustainable environment for growth. The streamlined process reduces barriers to entry for new projects and helps established protocols maintain a steady flow of liquidity, ensuring the stability and efficiency of the ecosystem.

To fully understand StakeStone’s capabilities, we will delve into its key features in more detail. These include:

- Security and stability measures

- The role of STONE tokens

- STONE pools

- Smart yield optimization strategies

- Cross-chain liquidity management

Each of these features contributes to StakeStone’s mission of creating an adaptive staking network that maximizes returns and enhances liquidity distribution.

Security and Stability Measures

In the realm of DeFi protocols, maintaining robust security and stability is critical, which holds true for StakeStone as well. The platform safeguards its users’ interests through a non-custodial setup that’s fully transparent, thereby granting users full command over their staked assets. This approach to self-custody without required permissions hands back control to the users, diminishing potential risks tied to centralization.

To strengthen this sense of security even more, recognized entities like Secure3 and Veridise conduct thorough audits on StakeStone. These examinations ensure that the platform’s security measures are up to standard, offering an extra layer of confidence for its user base. Through such initiatives, StakeStone fosters a secure and steady landscape where individuals can confidently stake their assets in pursuit of yields.

STONE Tokens: The Core Asset

The utilization of STONE tokens, which serve as evidence for staked ETH, is central to the StakeStone ecosystem. This allows participants within the protocol to monitor their investment progress effectively. In contrast to conventional tokens, smart contracts govern and incrementally augment the value of STONE tokens over time, bestowing a distinctive financial advantage on those who possess them.

Despite maintaining a constant token count, the cumulative value of STONE tokens escalates—this feature renders them particularly appealing for individuals focused on long-term investment strategies. For holders seeking to optimize their potential returns, engagement in STONE-Fi pools or committing LP tokens to secure enhanced rewards presents opportunities to Amplify their income prospects within this dynamic ecosystem.

STONE Pools

STONE-Fi serves as a specialized marketplace for the application layer, designed to streamline the distribution of liquid assets across different ecosystems and protocols. This system is tailored to ensure that liquidity is directed where it’s needed most by bridging distinctions between native liquidity within diverse environments. Stakestone is important for fostering growth by aligning the rewards for those who provide liquidity with different protocols and ecosystems.

By staking ETH on this platform, individuals can obtain STONE tokens, which offer them opportunities to maximize their earnings through participation in one of many STONE-Fi pools. Because of its omnichain feature, users can easily move their liquid assets across different chains, put these assets into various Liquidity Provider mining pools, and make the most of their investment in STONE.

The user-friendly dashboard provided by STONE-Fi gives investors clear visibility into all aspects related to providing liquidity, including tracking rewards and Annual Percentage Yield (APY). It also presents an organized venue for exploring new prospects and understanding upcoming launch conditions thoroughly.

StakeStone’s STONE-Fi

Smart Yield Optimization Strategies

StakeStone utilizes intelligent strategies for optimizing yield to enhance the generation of returns by dynamically redistributing assets into multiple high-yield prospects. It crafts these methods not only to optimize yield creation but also to enhance the secure returns users can achieve across various platforms through the restaking technique.

Taking StETH as an example, it can be restaked in EigenLayer or directed towards alternative strategic pools in pursuit of superior returns. This flexible methodology guarantees that users have access to prime market opportunities, providing them a pathway to bolster their investment outcomes.

Cross-Chain Liquidity Management

StakeStone leverages cutting-edge technology to streamline the management of assets across various blockchain networks. Utilizing Layer Zero, the platform enables secure transactions of both assets and their prices between numerous blockchains, diminishing obstacles and preventing the splintering of liquidity. This pioneering strategy is designed to establish a standard for liquidity that applies uniformly to underlying assets, promoting an integrated and effective ecosystem.

StakeStone prioritizes capital efficiency within its omnichain liquidity distribution network, whicnetwork for distributing liquidity to diverse opportunities with substantial yield potential across multiple chains. StakeStone’s ability in cross-chain liquidity management distinguishes it within the DeFi sector as a comprehensive resource for handling liquid assets efficiently.

Tokenomics

StakeStone’s native utility and governance token, $STO, is designed to align long-term incentives across all stakeholders, including users, partners, and builders. The token supports key functionalities such as protocol governance, yield boosting, and access to bribe rewards through vote-escrowed STO (veSTO). This alignment ensures that all participants are incentivized to contribute to the protocol’s success and sustainability.

Let’s explore the specifics of $STO’s token distribution, vesting schedule, governance role, and how to buy StakeStone (STO).

Token Distribution

The total supply of $STO tokens is capped at 1,000,000,000, with distribution designed to foster long-term alignment among contributors, investors, ecosystem participants, and community stakeholders.

The token distribution is as follows:

- Community (17.87%)

- Ecosystem and Treasury (4%)

- Team (15%)

- Foundation (18.65%)

- Airdrops & Future Incentives (7.85%)

- Marketing & Partnerships (9.13%)

- Liquidity (6%)

- Investors (21.5%)

Each category in the distribution plan plays a crucial role in supporting the protocol’s growth and sustainability. For example, the Community portion ensures that they will allocate a significant share of tokens to users who actively participate in the ecosystem, while the Foundation and Team allocations support ongoing development and strategic initiatives.

The well-balanced distribution of $STO tokens ensures that all stakeholders have a vested interest in the protocol’s success, aligning their incentives with StakeStone’s mission, vision, and fairness.

Token Distribution – Source: StakeStone Documents

Token Vesting Schedule

The vesting schedule for the StakeStone token is crafted to ensure enduring commitment among various stakeholders—including contributors, investors, participants within the ecosystem, and community members—throughout every phase. To cater to different groups’ needs, a custom vesting timeline is in place that aids in maintaining the protocol’s sustainable development and encourages thoughtful expansion.

StakeStone has meticulously orchestrated these vesting schedules with the objective of regulating token distribution. This prudent approach helps shield against abrupt shifts in market dynamics while fostering consistent progress aimed at long-term stability and growth within their ecosystem.

STO Token Vesting Schedule – Source: StakeStone Documents

The Role of $STO Token in Governance

StakeStone has adopted a governance framework that employs a vote-escrowed token system to harmonize the interests of its users with those of the protocol. In Q2 2025, Stakestone aims to launch a governance DAO guided by this model, which will oversee conversion processes and facilitate voting on governance matters.

Ownership of veSTO tokens entitles holders to proportional voting power based on the amount they choose to escrow. These stakeholders have the authority to determine the distribution of emissions among various liquidity pools and vaults. They can set crucial protocol guidelines such as fees charged by the platform and influence both strategic decisions and future development trajectories for StakeStone’s ecosystem.

How to Buy StakeStone (STO)

The process to obtain StakeStone (STO) tokens is uncomplicated and begins by selecting an exchange that lists STO. Several leading cryptocurrency exchanges, such as Binance, Bitget, KuCoin, and Gate.io, provide access to trading pairs with STO. Choose one of these platforms, register for an account, and follow through any required steps for KYC or account verification.

Following the completion of your verification step on the chosen platform, proceed to deposit funds into your account either through fiat currencies or by transferring crypto assets from another wallet. Seek STO trading pairs that match the asset you’ve funded your account with—if you have deposited Bitcoin (BTC), then pair it directly with STO/BTC, which helps avoid additional fees from executing multiple transactions.

Once you’ve found a trading pair that meets your needs, place an order according to your preferences. A market order will execute instantly at the current prices. Alternatively, a limit order allows setting up specific price parameters, whereupon reaching them triggers purchase initiation autonomously. Please confirm this transaction when you are ready.

Step-by-Step Guide to Earning Yields with StakeStone

Engaging with the StakeStone ecosystem and utilizing its staking protocols can be a lucrative endeavor that facilitates efficient asset management. By adhering to several straightforward procedures, you have the potential to garner appealing yields without compromising liquidity.

Our assistance will encompass guiding you through platform entry, wallet integration, initiating your ETH staking, and tracking your accrued earnings. Every phase is crafted for ease of use so that novices can effortlessly traverse through the features offered by StakeStone.

Accessing the Platform

Start your experience with StakeStone by navigating to their official page here. To gain entry to the array of staking opportunities on the platform, simply sign up by completing the registration steps.

With compatibility for well-known wallets such as Metamask and Rabby, StakeStone ensures that transactions are both safe and convenient. The interface offered by StakeStone is designed for ease of use, allowing users to effortlessly stake their compatible assets and begin accruing returns.

Source: StakeStone

Connecting Your Wallet

Initiating a connection between your wallet and the StakeStone platform is straightforward. Click on the ‘Connect Wallet’ option available within the user interface of the platform, making sure that your preferred wallet, for instance, Metamask, is prepared to establish a link.

Connecting Your Wallet

After you’ve made your selection, grant permission to StakeStone to interact with your wallet. This authorization is needed to access all of StakeStone’s staking opportunities and to ensure that your transactions are secure. With this integration completed, you can proceed to stake your assets and begin accruing returns.

Staking Your ETH

Committing your ETH to the StakeStone platform is a simple process. You only need as little as 0.01 ETH to participate, making it an inclusive option for investors of all sizes. After linking your wallet, just go to the staking area and determine the quantity of ETH you’re ready to commit.

Once you’ve locked in your ETH, STONE tokens equivalent to your deposited amount will be allocated by the platform. These tokens are a reflection of the value of your secured ETH, and they function in accruing profits relative to market trends.

By engaging with the stakestone network, there’s an opportunity for you to generate appealing yields on your invested assets.

Monitoring Your Earnings

StakeStone distinguishes itself by offering a real-time tracking system for your staking rewards. It presents an intuitive dashboard that offers comprehensive information about your assets and their prospective earnings. This feature of monitoring in real time enables you to be well-versed with the performance of your investments, assisting you in making informed choices based on data.

By providing up-to-date details regarding the assets you have staked, StakeStone bolsters engagement and heightens investor awareness about their holdings.

StakeStone Roadmap

StakeStone is consistently expanding its ecosystem and offering users cutting-edge methods for yield generation. In the first quarter of 2025, StakeStone introduced LiquidityPad, an innovative program that promises to reshape omnichain liquidity for the future. Through LiquidityPad, participants can tap into alpha opportunities and accrue token rewards by supplying liquidity across a diverse array of inter-chain applications and ecosystems.

This is just the beginning of StakeStone’s journey. Its roadmap encompasses numerous prospective projects and stages aimed at crafting a more resilient and adaptable staking network. By continuously seeking new ideas and improving its services, StakeStone aims to lead in starting a new era in DeFi, marked by better ways to manage liquidity, improved options for maximizing returns, and supporting growth in various projects.

Summary

Stakestone marks a pivotal development within the DeFi arena by presenting an all-encompassing strategy for effective and enduring distribution of liquidity. Utilizing cutting-edge technological advancements coupled with a commitment to community engagement, stakestone bolsters capital efficiency, streamlines the management of liquidity, and provides users with appealing opportunities to generate yield.

Looking ahead, StakeStone’s dedication to pioneering enhancements and fostering user agency will sustain its trajectory of success.

Frequently Asked Questions (FAQ)

What is StakeStone?

StakeStone is an omnichain liquidity protocol that enables users to stake diverse tokens for yield generation while preserving liquidity, utilizing smart contracts for automation, and managing the staking process efficiently.

How Does StakeStone Enhance Security?

StakeStone improves security through the use of a clear, non-custodial framework and by undergoing thorough evaluations from esteemed organizations such as Secure3 and Veridise. This feature ensures that users have full control over their staked assets via a permissionless, self-custodial system.

What are STONE Tokens?

The StakeStone protocol issues STONE tokens to users as proof of their staked ETH, enabling them to monitor their investments. Through smart contracts, these tokens accrue value over time, providing holders with benefits in terms of accounting.

How can I Buy StakeStone (STO) Tokens?

If you’re looking to purchase StakeStone (STO) tokens, first identify a trading platform that supports STO. Please make sure to complete any required verification processes. Fund your account, search for the STO trading pair, execute your order, and then transfer the acquired tokens to a safe wallet after the transaction finalizes.

What is the Role of $STO in Governance?

The veSTO tokens, representing a variant of the $STO token, are instrumental in governance as they grant voting privileges to their holders. This allows them to have a significant impact on critical decisions and settings within the protocol.

Such an approach promotes community engagement in overseeing the protocol’s management.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  LEO Token

LEO Token  WETH

WETH  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  Ethena USDe

Ethena USDe  Litecoin

Litecoin  Zcash

Zcash  Avalanche

Avalanche  Hyperliquid

Hyperliquid  Shiba Inu

Shiba Inu  Hedera

Hedera  Canton

Canton  USDT0

USDT0  sUSDS

sUSDS  World Liberty Financial

World Liberty Financial  Dai

Dai  Toncoin

Toncoin  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Uniswap

Uniswap  Polkadot

Polkadot  USD1

USD1  Mantle

Mantle  Rain

Rain  MemeCore

MemeCore  Bittensor

Bittensor  Aave

Aave