Bitcoin continues to hover above the $100,000 mark, and capital inflows from ETFs are surging. The biggest question in the crypto market right now is: “When will altcoin season truly begin?”

Altcoin season is defined as a period when altcoins outperform Bitcoin. Historically, major altcoin seasons occurred in 2017 and 2021, coinciding with the boom of ICOs, DeFi, NFTs, and Layer-2 solutions, according to Forbes.

During this phase, investment capital typically rotates from Bitcoin into altcoins, triggering sharp price increases, especially for large-cap and mid-cap altcoins – along with a surge in trading volume and growing FOMO sentiment.

Bitcoin Dominance: A Key Indicator

One of the most important indicators for identifying the start of an altcoin season is the Bitcoin Dominance Index (BTC.D), which reflects Bitcoin’s market capitalization relative to the entire crypto market.

According to data from TradingView, BTC.D peaked at 57.8% in late April 2025, before slightly retreating to around 55.2% by mid-May. As of now, TradingView reports that Bitcoin dominance stands at 63%, significantly higher than the 51% level recorded in November 2024.

Benjamin Cowen, a well-known cycle analyst, says if BTC.D drops below 52%, “that could be the confirmation signal that altcoin season is underway.”

However, Cowen also warned:

“Not every drop in BTC dominance results in an alt season. What matters is the inflow of new capital into altcoins – not just internal rotation.”

Capital Flows and Market Sentiment

Data from CoinShares show that investment funds have poured over $14 billion into Bitcoin ETFs since the beginning of 2025. However, inflows into ETH and other altcoins remain significantly lower, accounting for only about 8% of total capital — reflecting a defensive mindset among institutional investors, who continue to prioritize what they view as the safest asset in the crypto space.

Currently, the ETH/BTC pair remains stuck in a long-term downtrend that began in late 2021, with the 0.065 level acting as a critical resistance. This threshold is seen as the “confidence trigger”—a” point at which the market may begin to believe that altcoins are ready to enter a strong upward cycle.

Without a decisive breakout above this level, supported by strong volume and confirmation from broader market flows, even a rising Bitcoin price may not be enough to ignite a true altcoin season. In essence, altseason requires more than just bullish sentiment for BTC, it needs Ethereum to lead the charge.

As of May 14, ETH/BTC is hovering around 0.02 – well below the threshold needed to confirm a trend reversal.

Read more: Trading with Free Crypto Signals in Evening Trader Channel

Source: TradingView

Quantitative Indicators and On-Chain Data

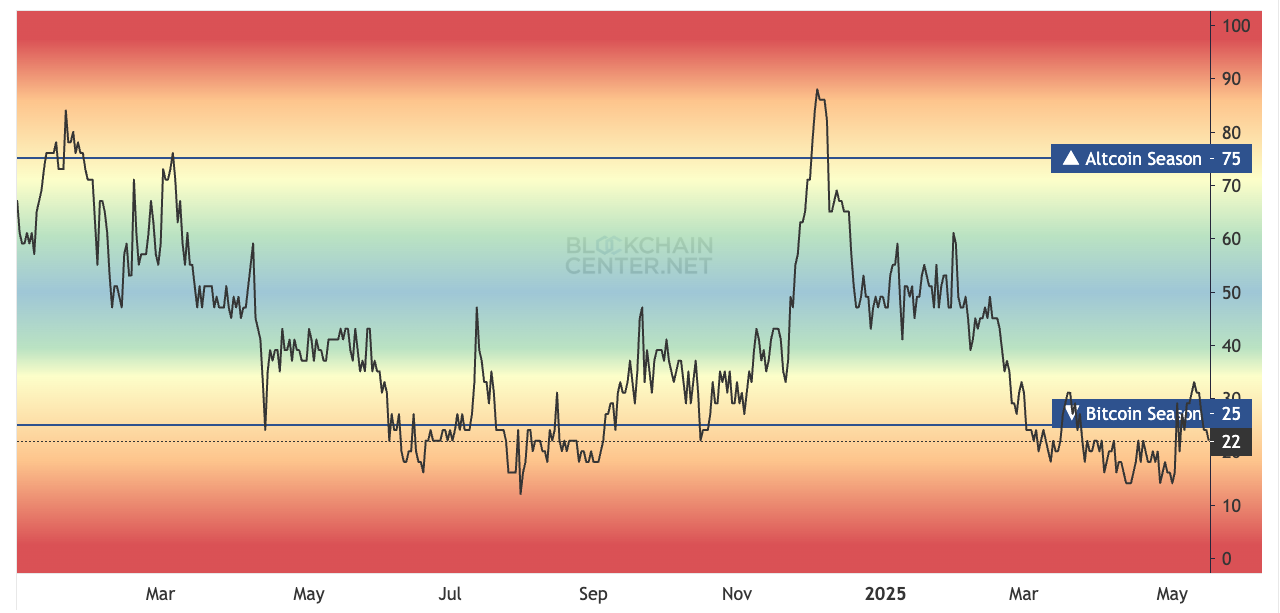

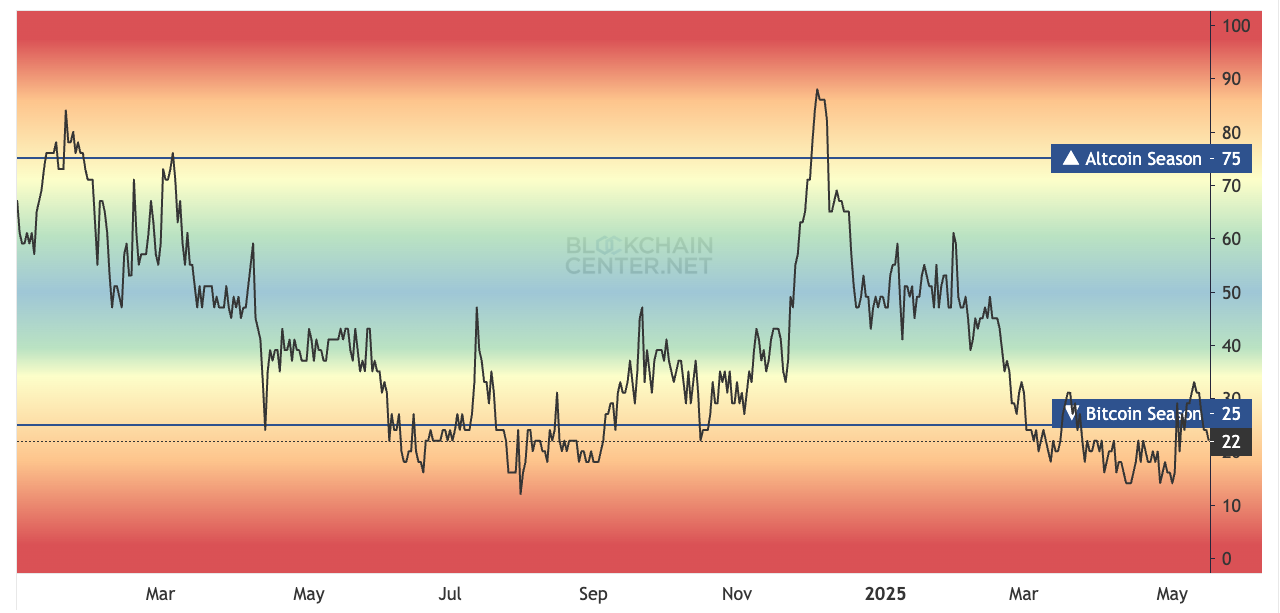

The Altcoin Season Index currently stands at 24, signaling “Bitcoin Season.” The Altcoin Month Index is at 57, and the Altcoin Year Index is at 27 – all below the 75-point threshold typically used to confirm an altcoin season.

Do note that these metrics are based on the performance of the top 50 coins (excluding stablecoins and asset-backed tokens) compared to Bitcoin over the past 90 days.

Source: BlockchainCenter

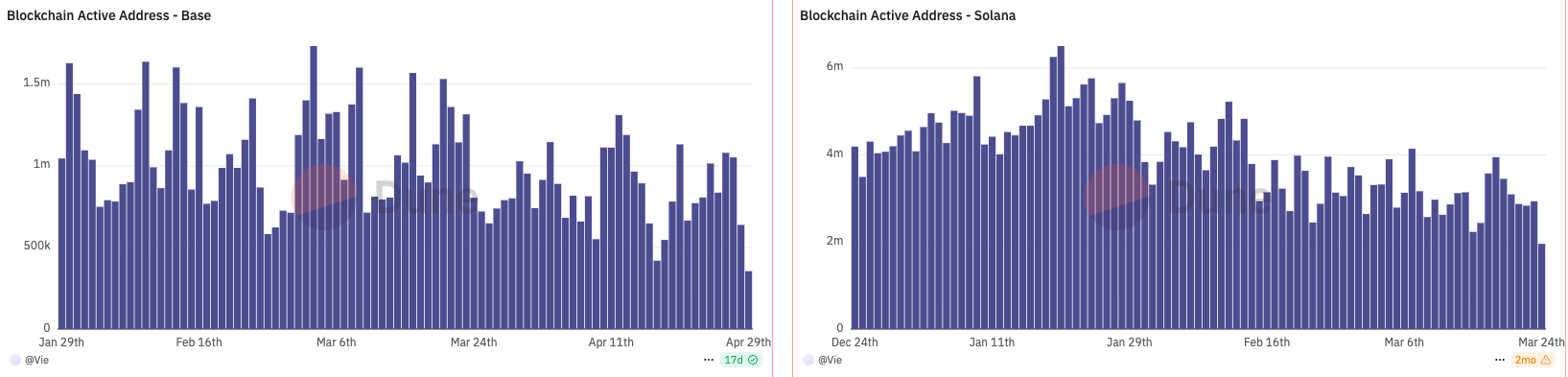

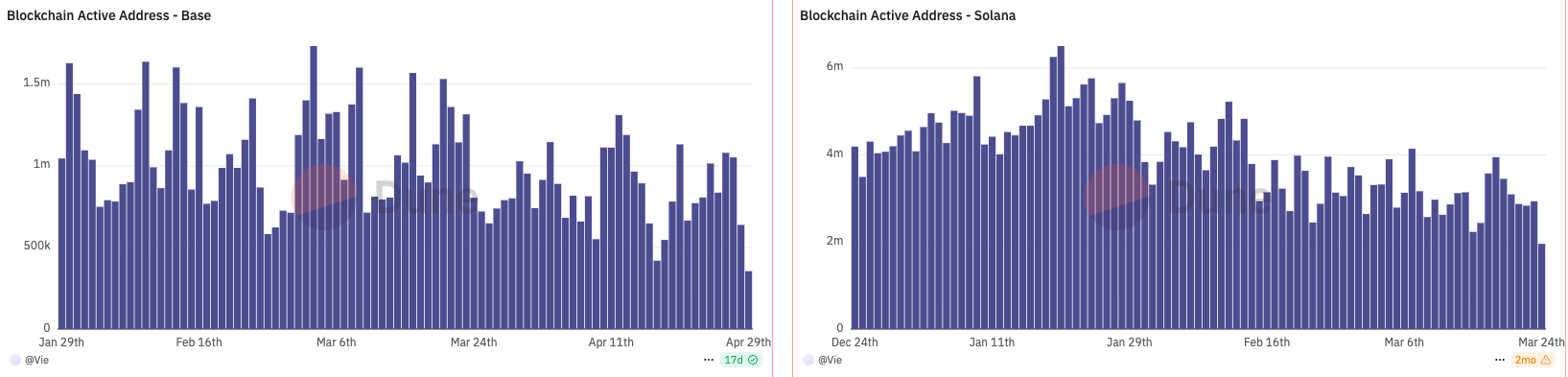

Followed by Dune Analytics, the number of new active wallets on chains like Solana and Base is rising again. Meanwhile, Ethereum gas fees remain below 30 gwei, indicating that the market hasn’t overheated yet but also suggesting ample room for future growth.

Source: Dune Analytics

There is currently a sharp divergence in forecasts for the 2025 altcoin season:

From a bullish perspective, altcoin season may have already begun, as altcoin market capitalization hit $1.89 trillion, surpassing its November 2021 peak of $1.79 trillion. Additionally, the Altcoin Season Index exceeded 75% on December 2, 2024, and stayed above that level for a full week, according to Blockchain Center.

However, more cautious views – like that of Benjamin Cowen, suggest that the altcoin season could be delayed, as BTC dominance remains high (60%) and monetary policy uncertainty lingers. Cowen warns that a lack of fresh capital and unsustainable performance could cause the market to stall.

From a selective outlook, Ki Young Ju, CEO of CryptoQuant, believes that only altcoins with strong fundamentals, real revenue, and ETF potential are likely to outperform in this cycle. “The era when everything goes up is over,” he said, implying a more mature and selective market environment.

Read more: CryptoQuant CEO: “A New Era for Bitcoin has Begun”

Key Drivers Behind Altcoin Season

Institutional capital remains a dominant force in crypto markets. Spot Bitcoin ETFs have attracted over $65 billion in net inflows as of May 2025, reinforcing BTC’s safe-haven status. However, this trend has also driven Bitcoin dominance above 55%, delaying the capital rotation into altcoins, which typically thrive in risk-on environments.

Several emerging sectors like AI, RWA, and DePIN are drawing investor interest. $VIRTUAL, a leading AI Agent project, has surged 249x, while RWA tokens saw up to 717% growth. Major institutions such as BlackRock and J.P. Morgan are actively piloting tokenized assets. Yet, gains remain concentrated in a few tokens, not enough to lift the broader altcoin market.

Despite rising narrative hype, true altseason won’t begin unless Ethereum and Solana lead the charge. The ETH/BTC ratio remains stuck below 0.065, signaling weak risk appetite. While Solana shows strong user traction, its ecosystem alone hasn’t pushed the Altseason Index beyond key breakout levels. Without a strong ETH rally, broad-based altcoin momentum remains limited.

U.S. interest rates have dropped from 5.25% to 4.19% year-over-year. If the Fed cuts rates further in Q3, it could trigger renewed appetite for risk assets. Meanwhile, political proposals like the U.S. Treasury potentially acquiring 200,000 BTC annually – if enacted, would significantly boost market sentiment and could catalyze capital inflow into altcoins.

Read more: Is XRP a Good Investment in 2025? A Comprehensive Guide for Investors

Source: CME Group

Conclusion

Taking into account technical indicators, capital flows, macroeconomic factors, and market sentiment, it’s clear that altcoin season has not officially begun, but the foundations for a potential breakout are gradually forming. A slight decline in BTC dominance, a stabilizing ETH/BTC ratio, whale accumulation, and the emergence of leading narrative tokens are all encouraging signs.

However, the market still requires further confirmation signals: a clear capital rotation from BTC into altcoins, the return of retail participation, and a rise in FOMO-driven sentiment. The second half of 2025 – if the Fed cuts interest rates and Ethereum breaks above $3,000, could mark the ideal timing for altcoin season to take off.

Read more: 15+ Best Crypto Signals Telegram Groups in 2025

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  LEO Token

LEO Token  WETH

WETH  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  Ethena USDe

Ethena USDe  Litecoin

Litecoin  Zcash

Zcash  Avalanche

Avalanche  Hyperliquid

Hyperliquid  Shiba Inu

Shiba Inu  Hedera

Hedera  Canton

Canton  USDT0

USDT0  sUSDS

sUSDS  World Liberty Financial

World Liberty Financial  Dai

Dai  Toncoin

Toncoin  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Uniswap

Uniswap  Polkadot

Polkadot  USD1

USD1  Mantle

Mantle  Rain

Rain  MemeCore

MemeCore  Bittensor

Bittensor