In an era where the boundaries between traditional finance (TradFi) and crypto continue to blur, the tokenization of real-world assets (RWAs) stands out as one of the hottest trends. This trend, which allows tangible assets like vehicles and real estate to be bought and sold as tokens on a blockchain, promises to revolutionize the efficiency and speed of asset transactions.

Just last week, BlackRock, the world’s largest asset manager, has positioned itself at the forefront of this movement with the launch of a $100 million tokenization fund, which has already attracted over $240 million in investment within its first week.

Larry Fink, CEO of BlackRock, has been vocal about the potential of tokenization, stating that RWAs “could revolutionize, again, finance.” This comment has contributed to a notable surge in the valuation of several RWA crypto tokens in recent weeks. In light of these developments, crypto analysts from Layergg have identified a specific crypto project that they believe could garner significant interest from BlackRock.

Why BlackRock Could Choose Aptos

The project in question is Aptos, which has been earmarked for its potential in the RWA space. According to Layergg’s analysis shared on X (formerly Twitter), the narrative surrounding RWA and tokenization, bolstered by BlackRock’s involvement, suggests a nascent yet rapidly growing interest in this sector.

They highlight that mid to low cap RWA projects listed on Binance have performed exceptionally well, indicating a broader market interest spurred by narrative-driven investment strategies. However, the favorite crypto project for BlackRock could be Aptos.

A closer look at Aptos reveals several factors that might make it an attractive partner for BlackRock. Firstly, Aptos is poised to make a significant announcement related to RWA in April, coinciding with the Aptos DeFi DAYS event from April 2 to 5.

This announcement is speculated to involve a partnership with a global asset management firm, potentially BlackRock. “A partnership with a global asset management firm is expected to be announced. It is speculated that this may include BlackRock,” the analysts remarked.

The basis for this speculation includes Aptos CEO Mo Shaikh’s previous tenure at BlackRock, suggesting pre-existing industry connections that could facilitate such a partnership.

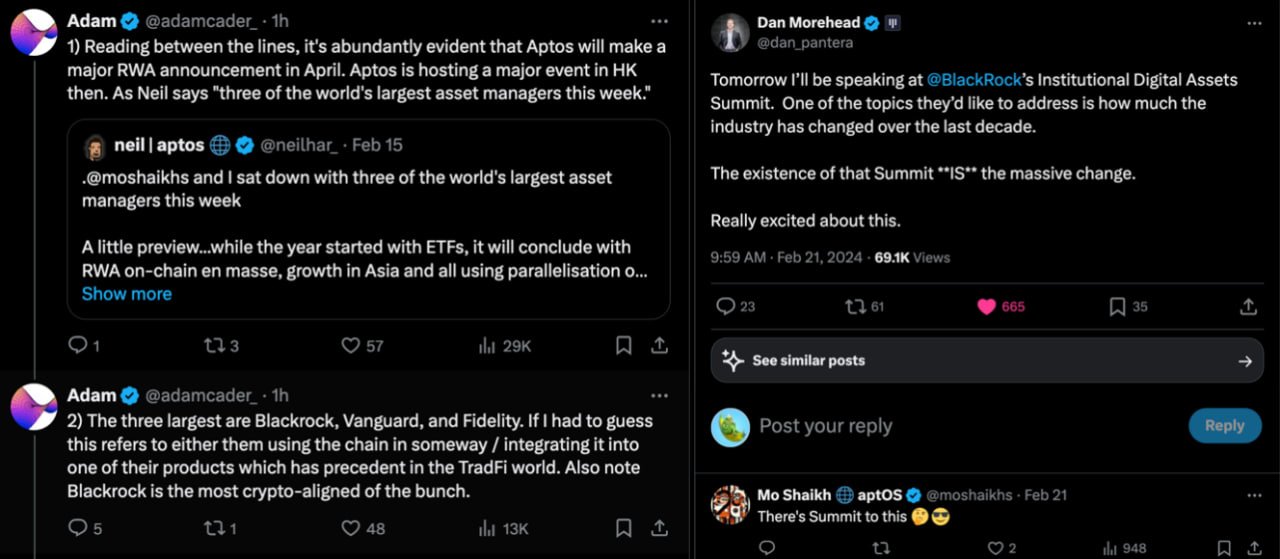

Moreover, Aptos founder Mo Shaikh & head of ecosystem at Aptos Labs Neil H hinted at this early on. In mid-February Shaikh revealed via X: “I sat down with three of the world’s largest asset managers this week A little preview…while the year started with ETFs, it will conclude with RWA on-chain en masse, growth in Asia and all using parallelisation on Aptos See you in Hong Kong.”

On February 21, Shaikh also commented on a post on X by Dan Morehead, founder and managing partner at Pantera Capital. Morehead stated, “Tomorrow I’ll be speaking at BlackRock’s Institutional Digital Assets Summit. […] The existence of that Summit **IS** the massive change. Really excited about this.” Mo Shaikh mysteriously commented, “There’s Summit to this.”

Besides that, Adam Cader, founder of Thala Labs recently stated via X that “something is cooking for Aptos. I’m a co-founder of the largest application on the network, and here’s my list of upcoming significant ecosystem wide catalysts.” Cader referenced Shaikh’s statement and added that Blackrock, Vanguard, and Fidelity are the three largest asset managers in the world.

“If I had to guess this refers to either them using the chain in some way / integrating it into one of their products which has precedent in the TradFi world. Also note Blackrock is the most crypto-aligned of the bunch,” he said via X.

Crypto Revolution: Will APT Follow AVAX?

But that’s not all. Aptos has been hinted to explore partnerships with other major asset management firms, including Franklin Templeton, which has previously invested in Aptos (tier 3) and planned to utilize its blockchain for money market funds.

Such strategic alliances could position Aptos similarly to how Avalanche benefited from its partnerships in the Project Guardian initiative (JPMorgan and Wisdomtree), experiencing a substantial price increase post-announcement. “Avalanche saw a price increase of more than 4x following the ‘Project Guardian’ news,” Layergg noted.

They concluded, “If a partnership with BlackRock proceeds, more ‘Big partnerships’ will naturally follow.”

At press time, APT traded at $17.59, up 87% over the past five weeks.

Featured image from Pensions & Investments, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  JUSD

JUSD  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  LEO Token

LEO Token  Chainlink

Chainlink  Hyperliquid

Hyperliquid  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WETH

WETH  Stellar

Stellar  Ethena USDe

Ethena USDe  Canton

Canton  Zcash

Zcash  Litecoin

Litecoin  Sui

Sui  Avalanche

Avalanche  USD1

USD1  Hedera

Hedera  Shiba Inu

Shiba Inu  World Liberty Financial

World Liberty Financial  USDT0

USDT0  Dai

Dai  sUSDS

sUSDS  PayPal USD

PayPal USD  Ethena Staked USDe

Ethena Staked USDe  Toncoin

Toncoin  Cronos

Cronos  Rain

Rain  Polkadot

Polkadot  Uniswap

Uniswap  Mantle

Mantle  Tether Gold

Tether Gold  MemeCore

MemeCore