Ethereum (ETH), the world’s second-largest cryptocurrency by market capitalization, is once again making headlines.

As of May 30, 2025, Ethereum (ETH) closed at approximately $2,676.27, marking a 45% increase from the previous 30-day. Trading volume surged to over $27 billion, according to CoinGecko data.

Ethereum Retreats to $2,676 Despite Strong Fundamentals

The pullback, while notable, comes on the heels of a multi-week rally that saw ETH gain over 45% in value in just 30 days. Such short-term corrections are not uncommon during periods of rapid appreciation and may be more indicative of healthy profit-taking than a reversal in trend.

This decline also coincides with a broader cooling in crypto markets amid month-end rebalancing activity by institutional funds and increased volatility ahead of the upcoming U.S. employment and inflation data releases. However, unlike previous downturns triggered by regulatory uncertainty or systemic risks, this recent dip in ETH appears more technical than fundamental.

It’s also worth noting that extended periods of upward momentum often result in temporary slowdowns, as traders begin locking in profits. These pauses, while sometimes perceived as setbacks, can be part of a healthy market cycle that supports longer-term stability.

Source: CoinGecko

What makes this decline particularly noteworthy is that it occurs in the context of exceptionally strong structural growth for Ethereum. Institutional demand, staking participation, and on-chain metrics have all remained robust – signaling confidence in Ethereum’s long-term trajectory. The dip has even been framed by some market analysts as a potential accumulation opportunity, particularly for investors who missed the recent surge.

Moreover, the growing role of Ethereum as a yield-bearing asset – via staking, and its increasing integration into traditional finance systems through ETFs and derivatives products is reshaping its market profile.

Read more: Trading with Free Crypto Signals in Evening Trader Channel

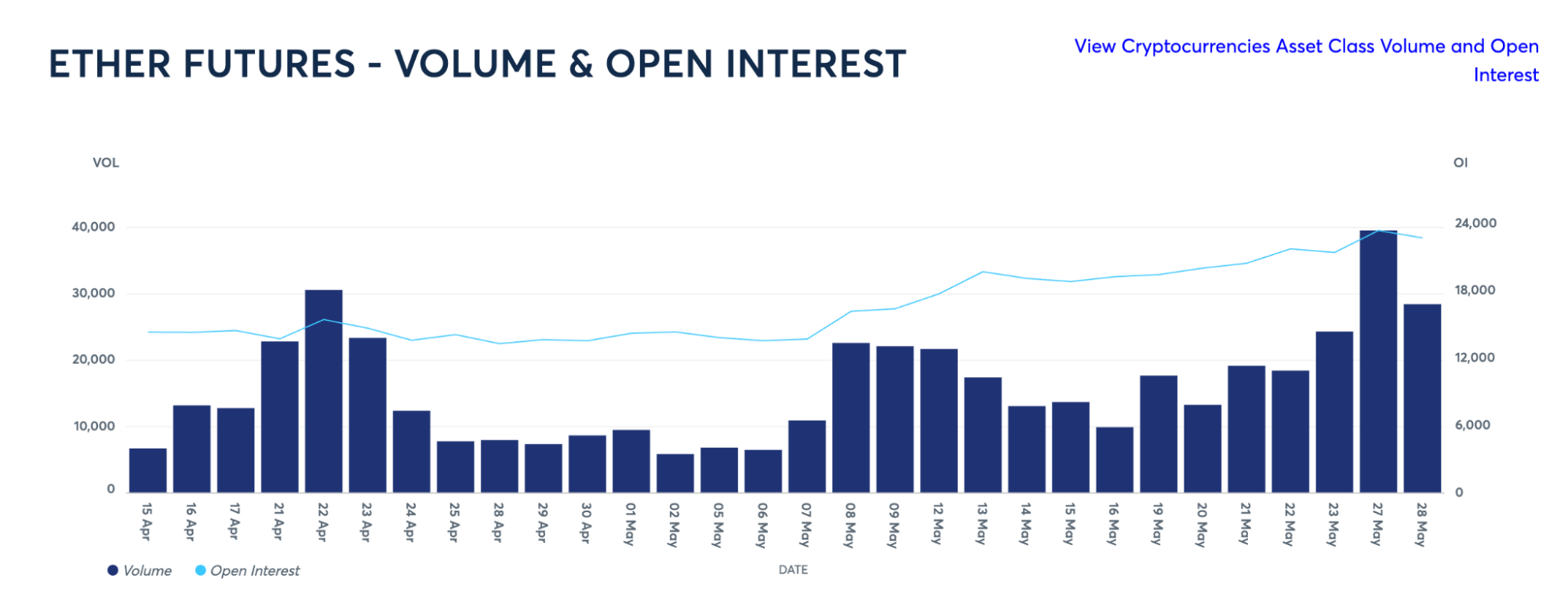

Institutional Interest Spikes

Institutional interest in Ethereum has surged significantly in the aftermath of the SEC’s approval of spot ETH ETFs. Trading desks at firms like Galaxy Digital and Bybit Institutional have reported a notable increase in large block trades, indicating a wave of coordinated buying activity by professional investors looking for ETH exposure across both spot and derivatives markets.

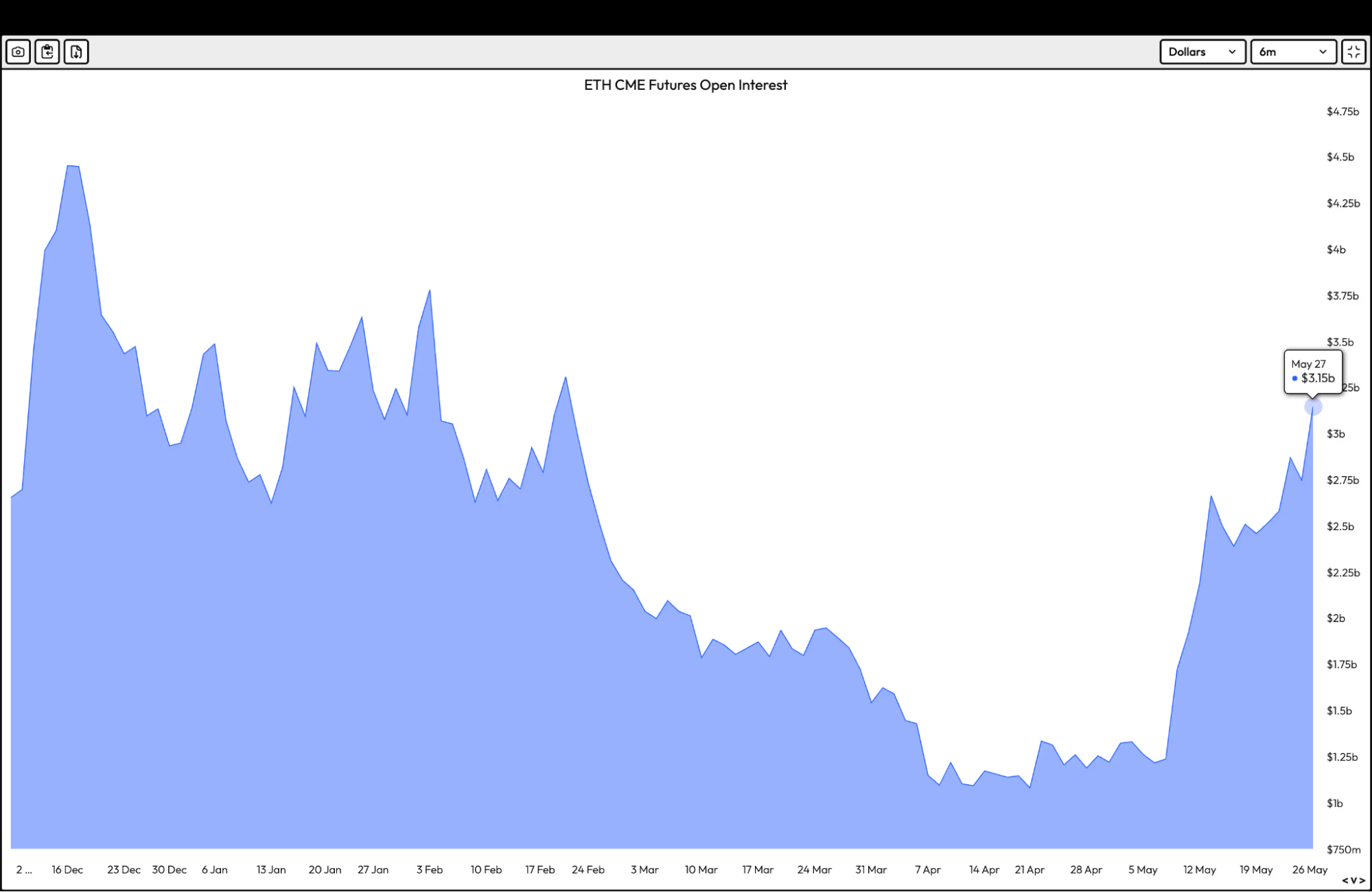

Open interest on Ethereum futures contracts listed on the Chicago Mercantile Exchange (CME) has soared to an all-time high of $3.15 billion – marking a 186% increase since early April. This uptick underscores a rising demand among institutional traders who are deploying ETH derivatives for a mix of speculative positioning and structured hedging.

Source: CME Group

Although explicit confirmation of a shift into contango on the CME ETH futures curve was not found, the rapid growth in futures activity and rising open interest suggest market participants anticipate further ETH appreciation.

This aligns with the broader narrative of Ethereum maturing into a programmable and yield-bearing digital asset favored by long-term institutional capital.

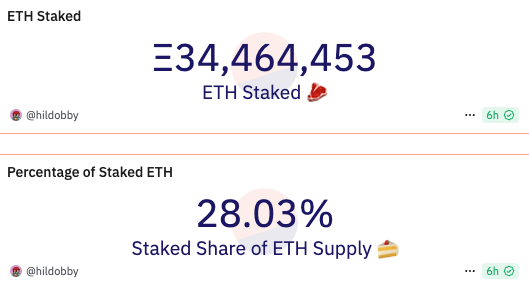

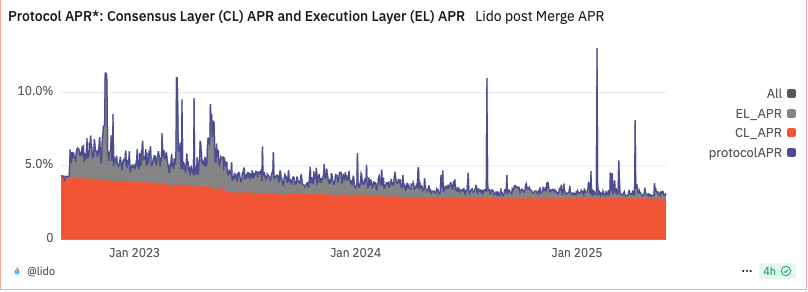

Ethereum Staking and Yield Metrics Strengthen

Staking activity on Ethereum continues to expand, though recent data indicates the need to adjust earlier assumptions. As of late May 2025, approximately 34.46 million ETH – about 28% of the total supply, has been locked in staking contracts, according to on-chain analytics.

This still represents a robust signal of confidence among long-term holders, who see staking as a dual benefit: contributing to Ethereum’s network security while earning passive income.

Source: Dune

Annualized staking rewards currently hover around 3.0%, making ETH an attractive option for yield-seeking investors amid softening global interest rate environments.

Decentralized staking protocols remain central to this growth. Lido Finance leads the market with over 9 million ETH staked under its platform, while Rocket Pool continues to gain momentum by offering decentralized and permissionless staking alternatives that broaden access for smaller holders.

Source: Dune

The continued evolution of Ethereum’s staking landscape illustrates how yield-generation is becoming a pillar of ETH’s value proposition – complementing its roles in DeFi, NFTs, and infrastructure, and reinforcing the asset’s broader institutional appeal.

Read more: ETH Price Prediction after Pectra Upgrade in May

Positive Macroeconomic Signals Amid Rate Cut Speculation

Ethereum’s latest price rally is benefiting from a more favorable global macroeconomic outlook. The U.S. Consumer Price Index (CPI) for April 2025 – the most recent available reading, registered at 2.3% year-over-year, a notable decline from March’s 2.4% and below analyst expectations.

While core CPI, which excludes volatile food and energy prices, remained at 2.8%, the broader easing of inflation has improved risk sentiment across financial markets.

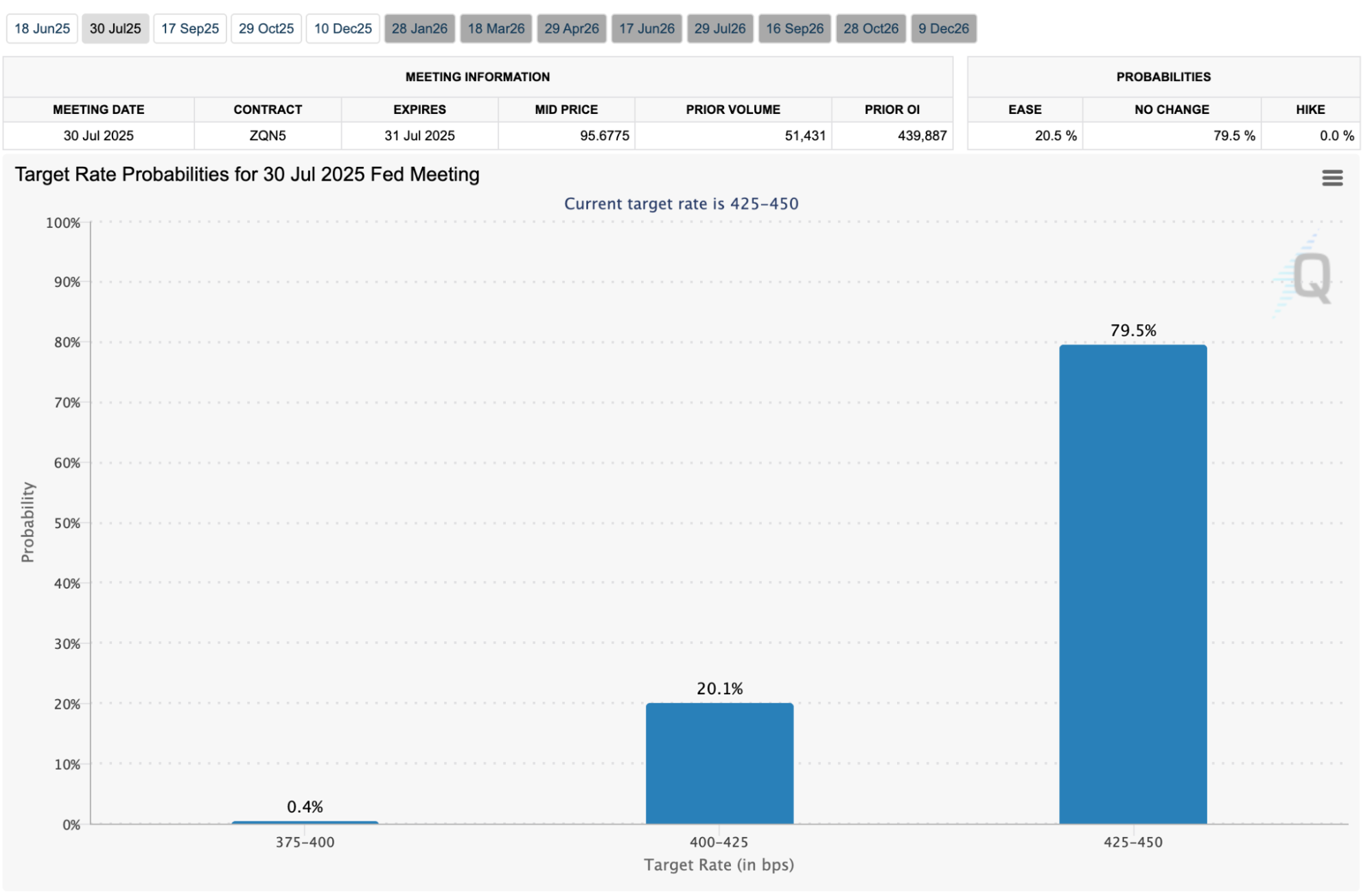

This cooling inflation has fueled speculation that the U.S. Federal Reserve may consider interest rate cuts later in the year.

Although the Fed maintained its benchmark rate in the 4.25% to 4.5% range during its early May meeting, several market participants expect more accommodative policy in Q3 or Q4 if disinflation continues and the labor market softens. Such expectations are bullish for crypto assets, which tend to thrive in low-yield, liquidity-driven environments.

Real yields on U.S. Treasuries have also edged lower, prompting institutional investors to seek higher returns in alternative asset classes. Ethereum, with its native staking yield and foundational role in DeFi and Web3, is increasingly viewed as a high-conviction asset in this macro context. The yield component of ETH, coupled with its programmable infrastructure, makes it an attractive hedge against stagnation in traditional fixed-income instruments.

Globally, dovish tones from central banks in Europe and Asia are reinforcing a synchronized shift toward looser financial conditions. This coordinated backdrop has improved the overall risk appetite and contributed to strong inflows into crypto markets. Ethereum, in particular, has benefited from this macro tailwind alongside increased ETF inflows and elevated retail interest.

Whale Accumulation, Exchange Flows, and On-Chain Sentiment

Glassnode and Nansen analytics indicate a sharp increase in whale accumulation. In the past two weeks alone, the number of wallets holding more than 10,000 ETH has grown by approximately 4%, with 13 new whale wallets appearing within a single 24-hour window – an unusually aggressive spike. This suggests strategic positioning by large holders in anticipation of further market upside.

In tandem, net ETH exchange flows have turned decisively negative. Over $380 million in ETH has been withdrawn from centralized exchanges in the past week, marking the largest outflow in nearly two years.

Such behavior reflects strong conviction among long-term investors, as assets move toward cold wallets or staking protocols rather than being kept liquid for trading.

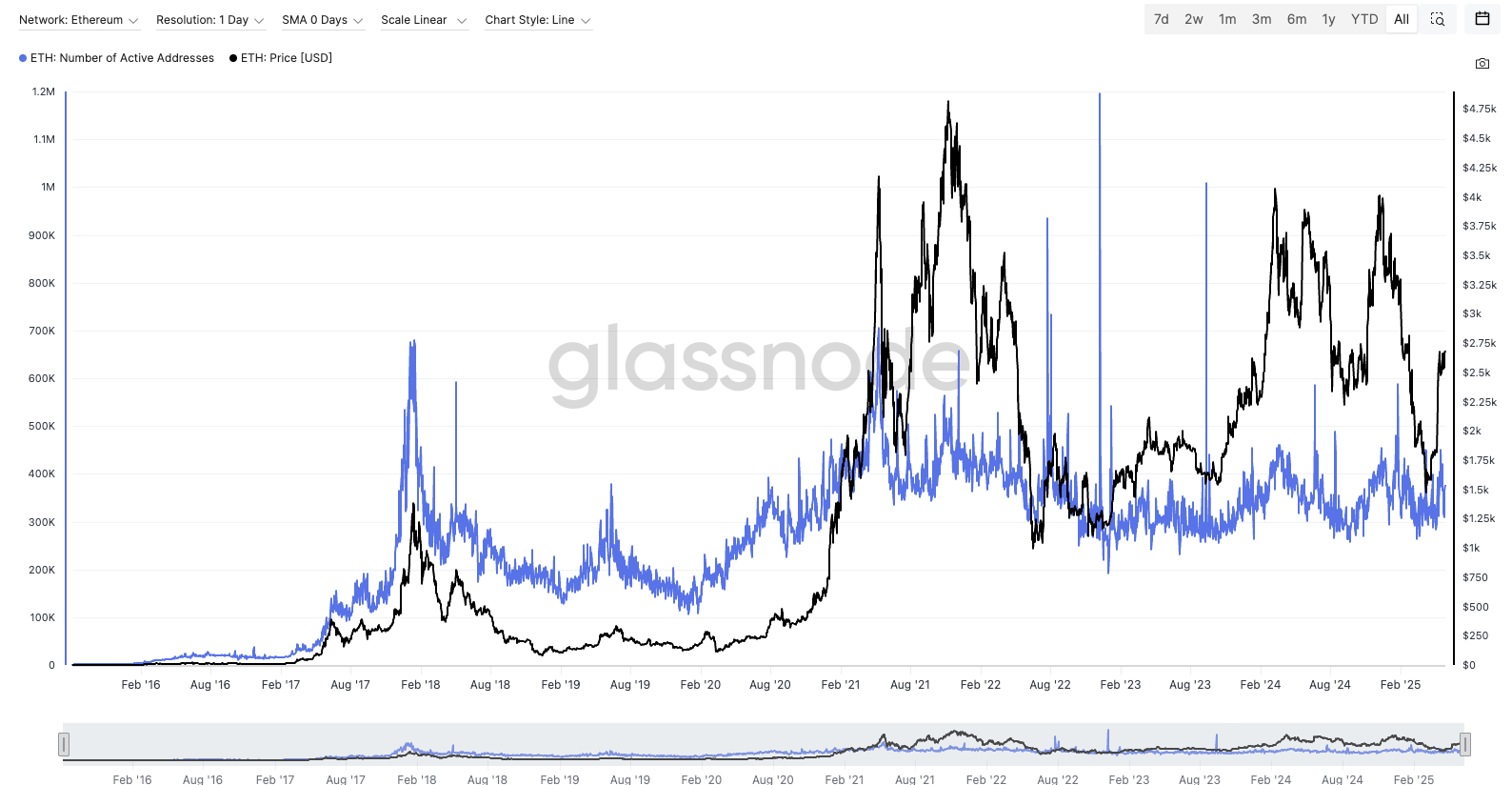

On-chain activity has also accelerated. Daily active addresses surged to a 24-month high, reaching around 650,000 on May 17, 2025. Gas usage is on the rise as well, signaling growing demand for block space and interaction with smart contracts.

Additionally, Ethereum now boasts over 27 million addresses with a non-zero balance, evidence of widening network participation.

Collectively, these signals form a bullish on-chain backdrop. Capital inflows, rising user engagement, and large-scale accumulation are aligning to reinforce Ethereum’s upward momentum and market resilience.

Conclusion

Ethereum’s current rally draws strength from several powerful drivers: regulators clarifying ETF guidelines, institutions increasing their inflows, on-chain metrics showing consistent growth, macro trends supporting risk assets, and developers accelerating innovation across the ecosystem. Unlike previous speculative rallies, today’s growth narrative for ETH appears grounded in fundamentals.

While some short-term volatility may arise as traders digest gains, Ethereum’s longer-term outlook is increasingly optimistic. As traditional finance continues merging with decentralized platforms, ETH remains well-positioned as the foundational asset for the next phase of digital finance.

Read more: ETH Hasn’t Peaked Yet: Missing Signals Before ETH Truly Breaks Out

The post Why is ETH Down Today? appeared first on NFT Evening.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Wrapped SOL

Wrapped SOL  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Wrapped Bitcoin

Wrapped Bitcoin  Monero

Monero  Wrapped eETH

Wrapped eETH  Chainlink

Chainlink  USDS

USDS  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  WETH

WETH  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Stellar

Stellar  Zcash

Zcash  Sui

Sui  Ethena USDe

Ethena USDe  Hyperliquid

Hyperliquid  Avalanche

Avalanche  Litecoin

Litecoin  Hedera

Hedera  Shiba Inu

Shiba Inu  Canton

Canton  USDT0

USDT0  World Liberty Financial

World Liberty Financial  Dai

Dai  Toncoin

Toncoin  Cronos

Cronos  sUSDS

sUSDS  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Polkadot

Polkadot  USD1

USD1  Uniswap

Uniswap  Rain

Rain  Mantle

Mantle  MemeCore

MemeCore  Bittensor

Bittensor