Ethereum has long stood as a cornerstone of the crypto world, powering decentralized apps, NFTs, and staking innovations. As Ethereum evolves with its robust ecosystem, one question raised through the crypto community: Will Ethereum rise in 2025 and how high can it go?

Our recent survey data suggests an Ethereum bullish sentiment, with investors showing strong conviction in ETH’s upward trajectory. These findings reveal critical insights about Ethereum holders, their behaviors, and more importantly, their outlook on ETH’s future.

How many Ethereum holders are there?

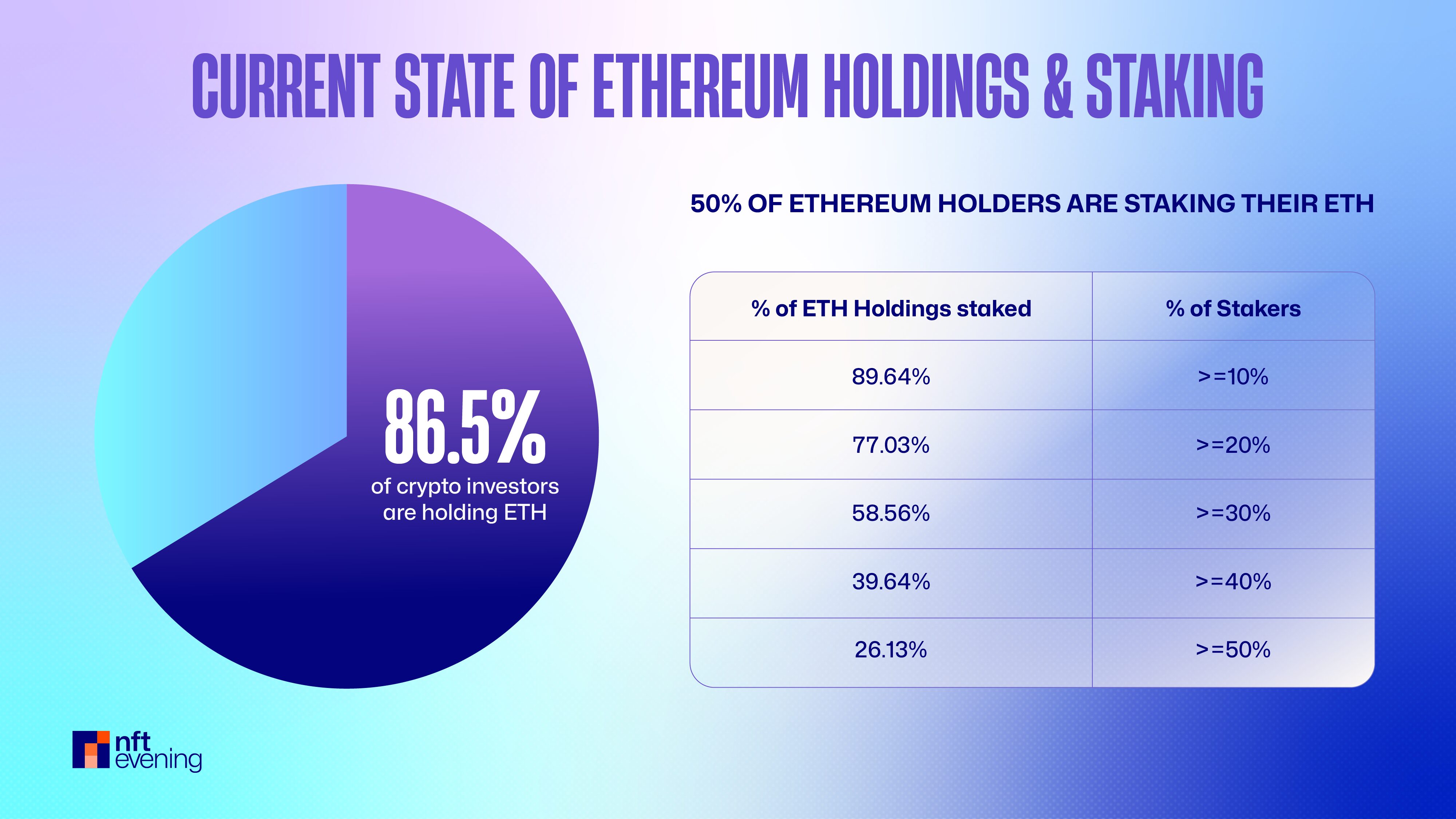

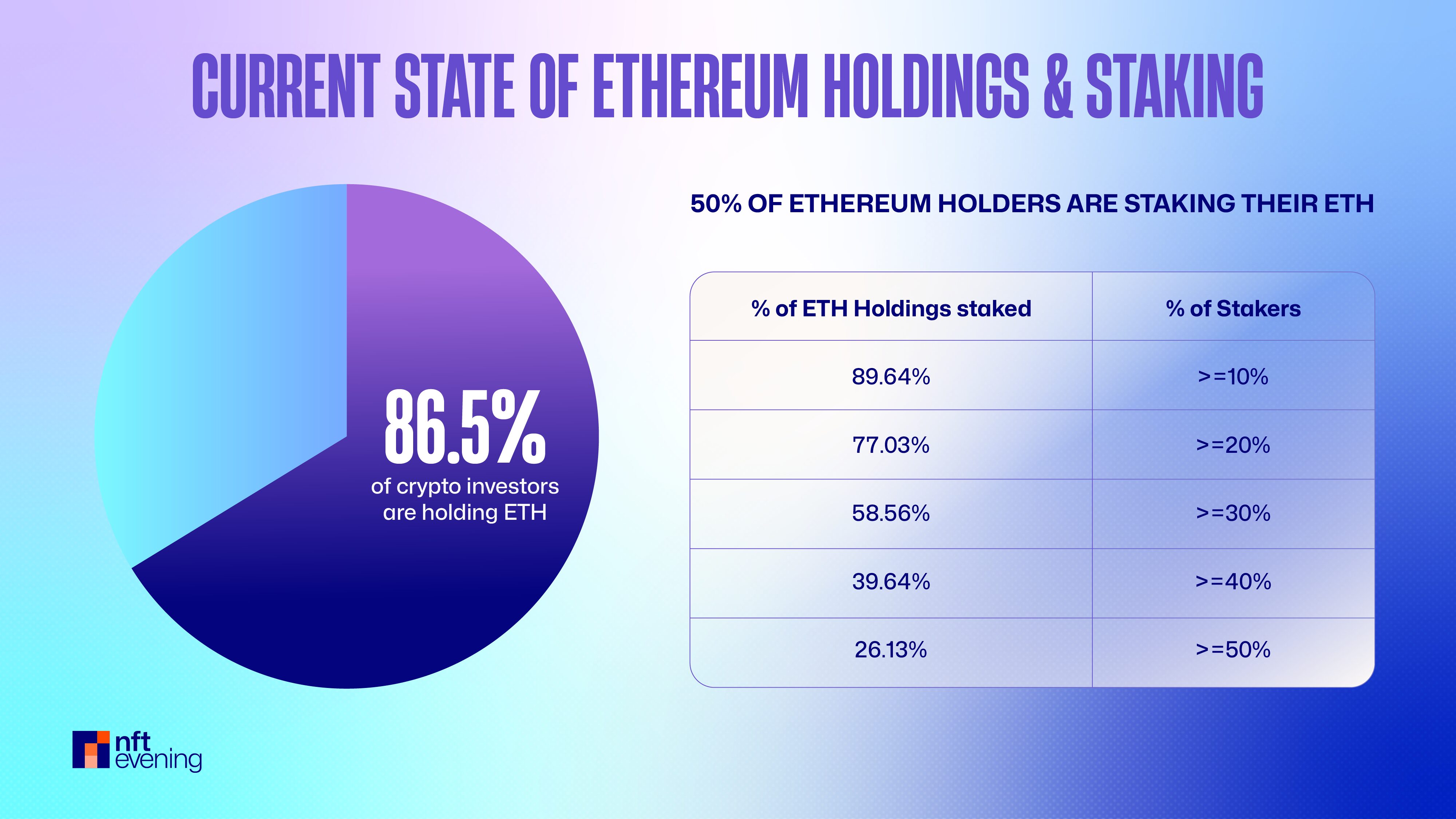

Our survey reveals that an impressive 86.5% of crypto investors currently hold Ethereum. This widespread ownership highlights Ethereum’s essential position within the cryptocurrency ecosystem. It has transformed from simple speculation into a key investment in various portfolios.

Moreover, it’s not passive holding either. Half of all ETH holders are also staking their tokens, actively participating in Ethereum’s transition to a fully proof-of-stake network.

How much ETH are people actually staking?

Almost 60% of ETH stakers are committing at least 30% of their holdings, and over a quarter are staking more than half of their ETH. This level of commitment signals strong long-term conviction, exceeding market averages.

The Ethereum staking landscape has evolved dramatically, with the rise of liquid staking platforms as well as staking through centralized exchanges. This has made it easier than ever for investors to earn yield while maintaining their Ethereum bullish outlook for long-term appreciation.

Ethereum’s Allocation in Portfolios

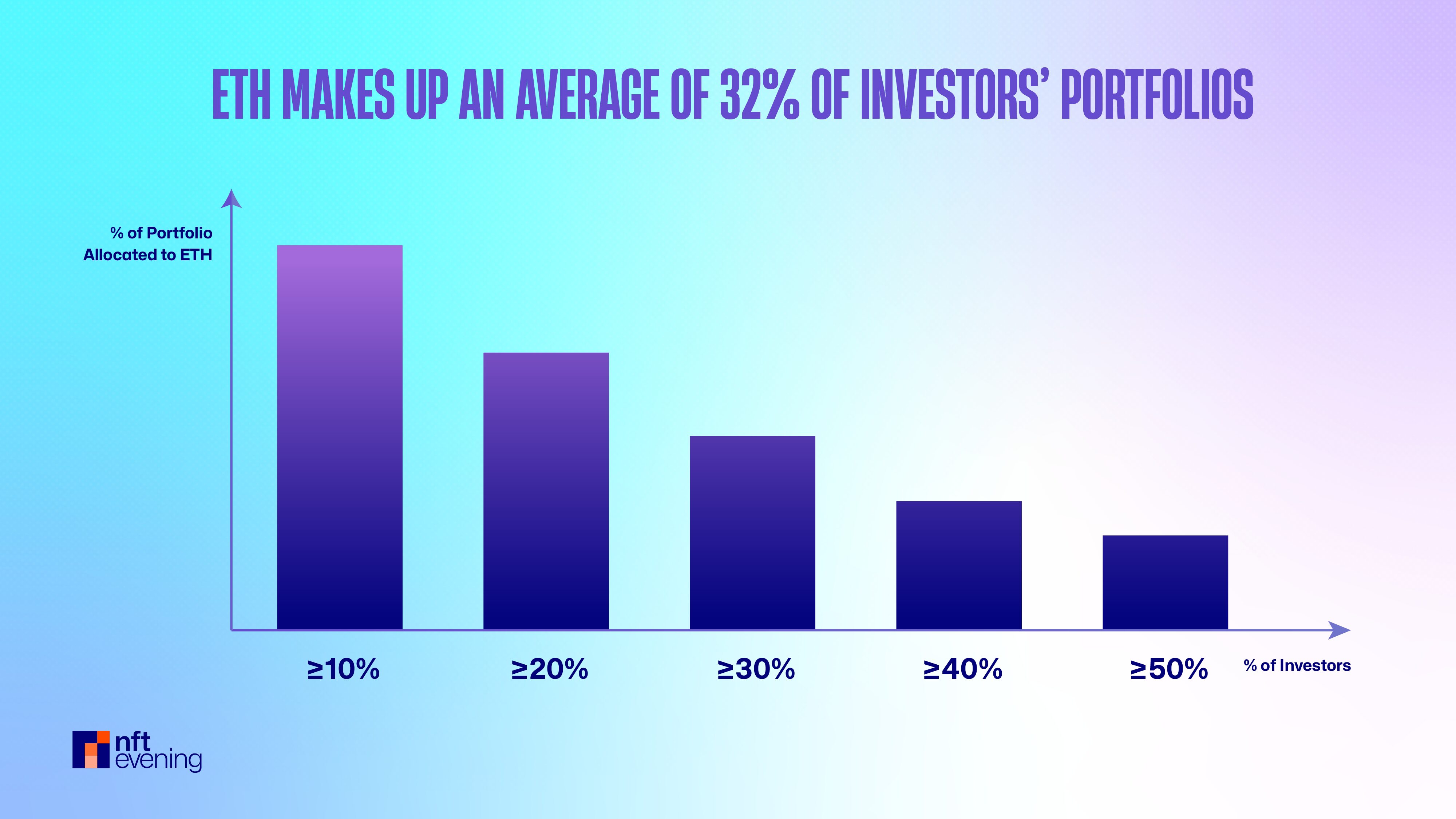

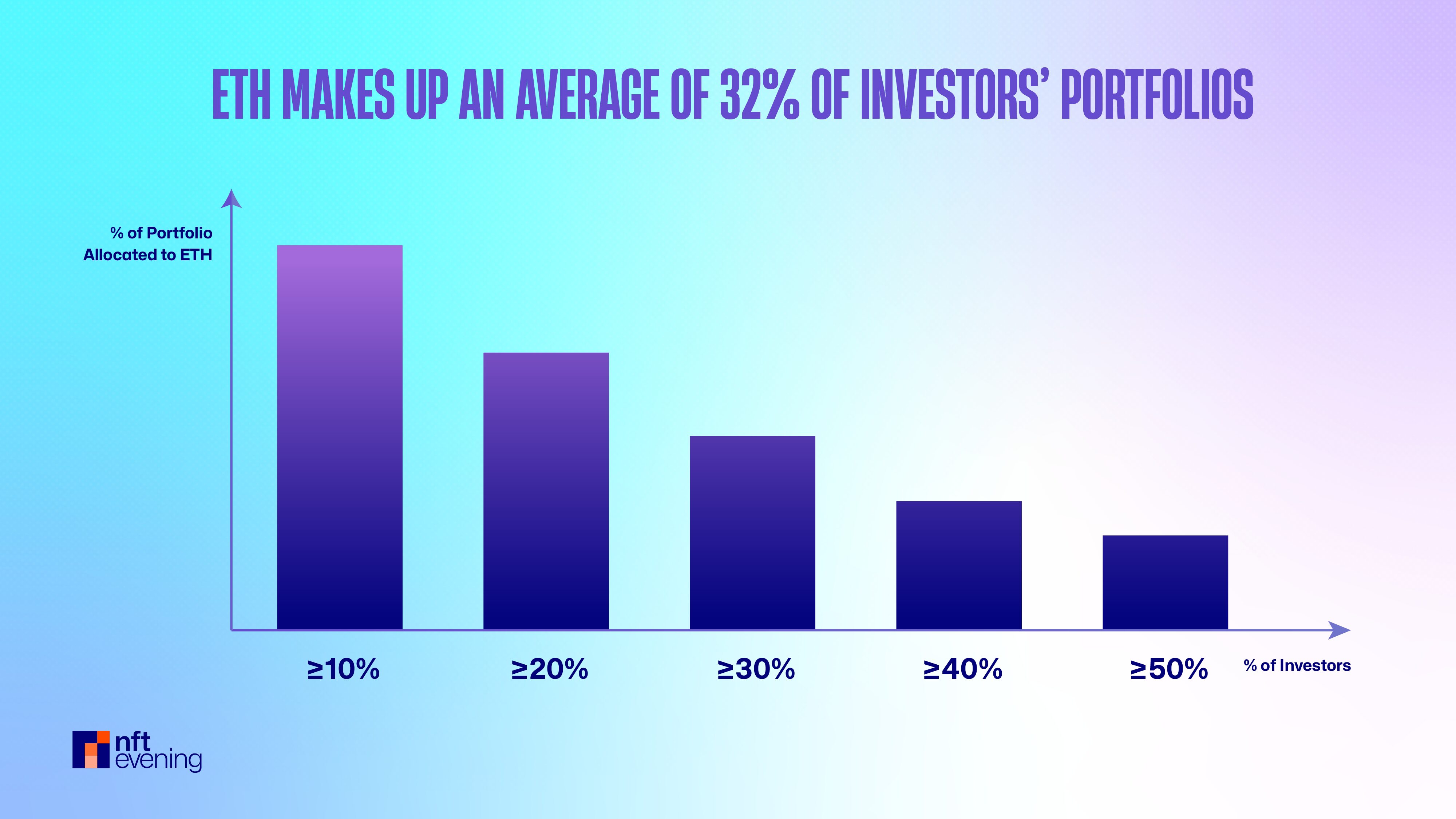

The data reveals that ETH isn’t just another altcoin – it’s a cornerstone holding in most crypto portfolios, reflecting strong ethereum holding patterns among investors.

The average 32% portfolio allocation demonstrates remarkable confidence. This substantial commitment suggests investors aren’t merely speculating but are positioning ETH as a foundational asset, rivaling Bitcoin’s dominance in many portfolios.

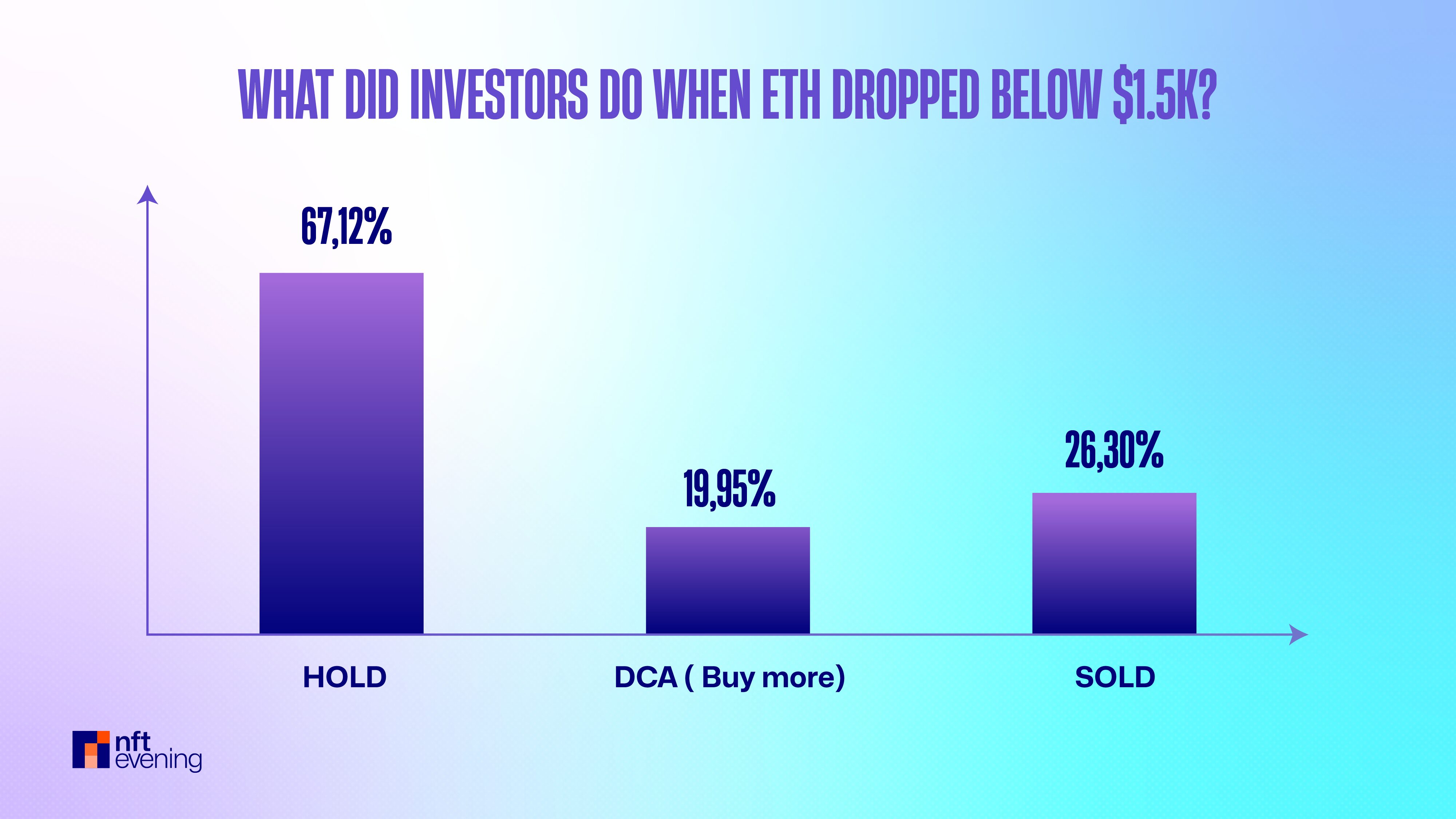

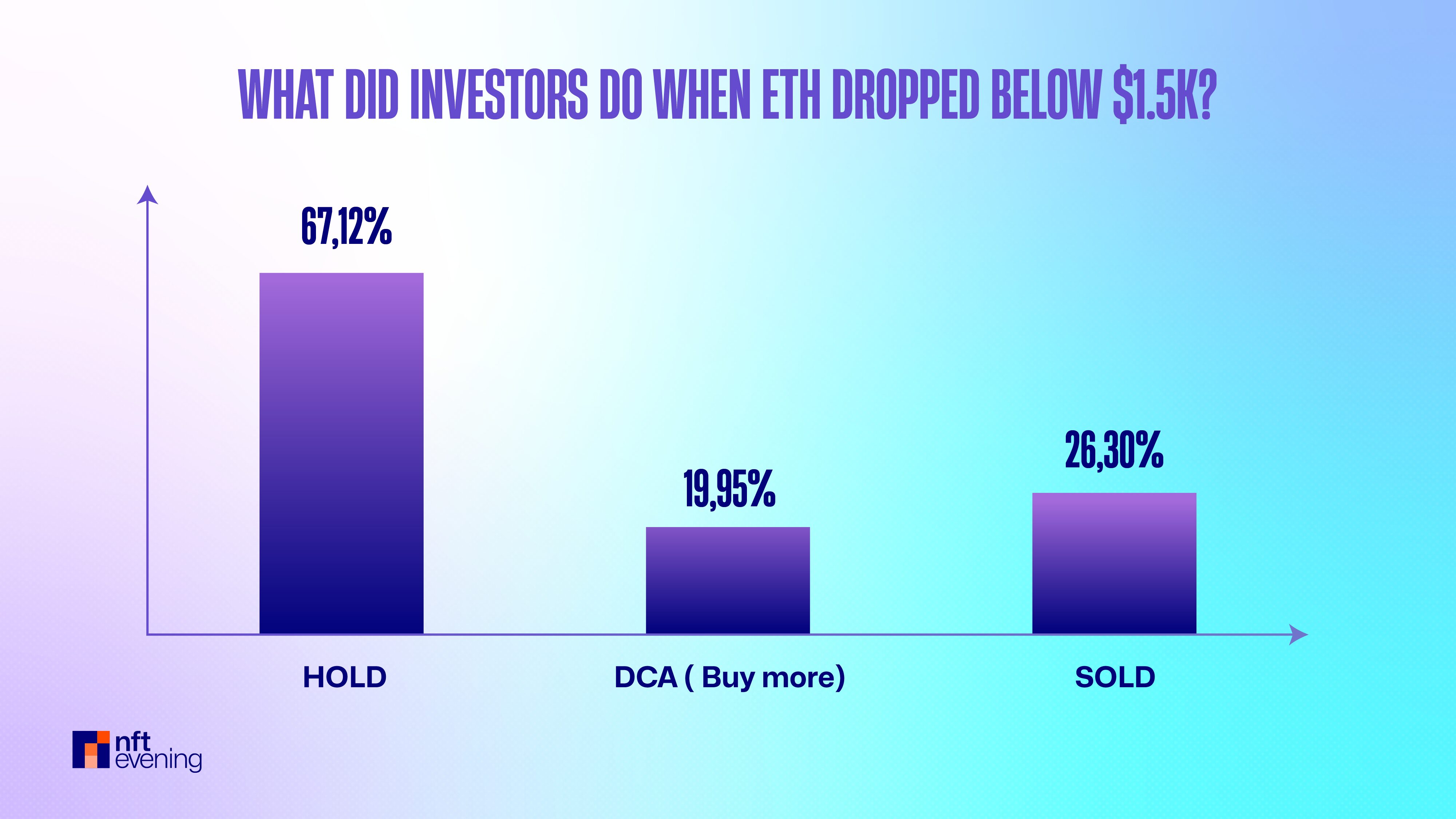

What Did Investors Do When ETH Dropped Below $1.5K?

Market corrections test investor resolve. When ETH dipped under $1,500 in April, investors had three choices: panic sell, do nothing, or buy more. Here’s what they actually did:

The data shows impressive conviction – 67% held firm while nearly 20% increased their positions. This means approximately 87% of investors maintained their Ethereum bullish stance even during significant market stress. Such behavior historically precedes major rallies, particularly when considering whether Ethereum price can go up.

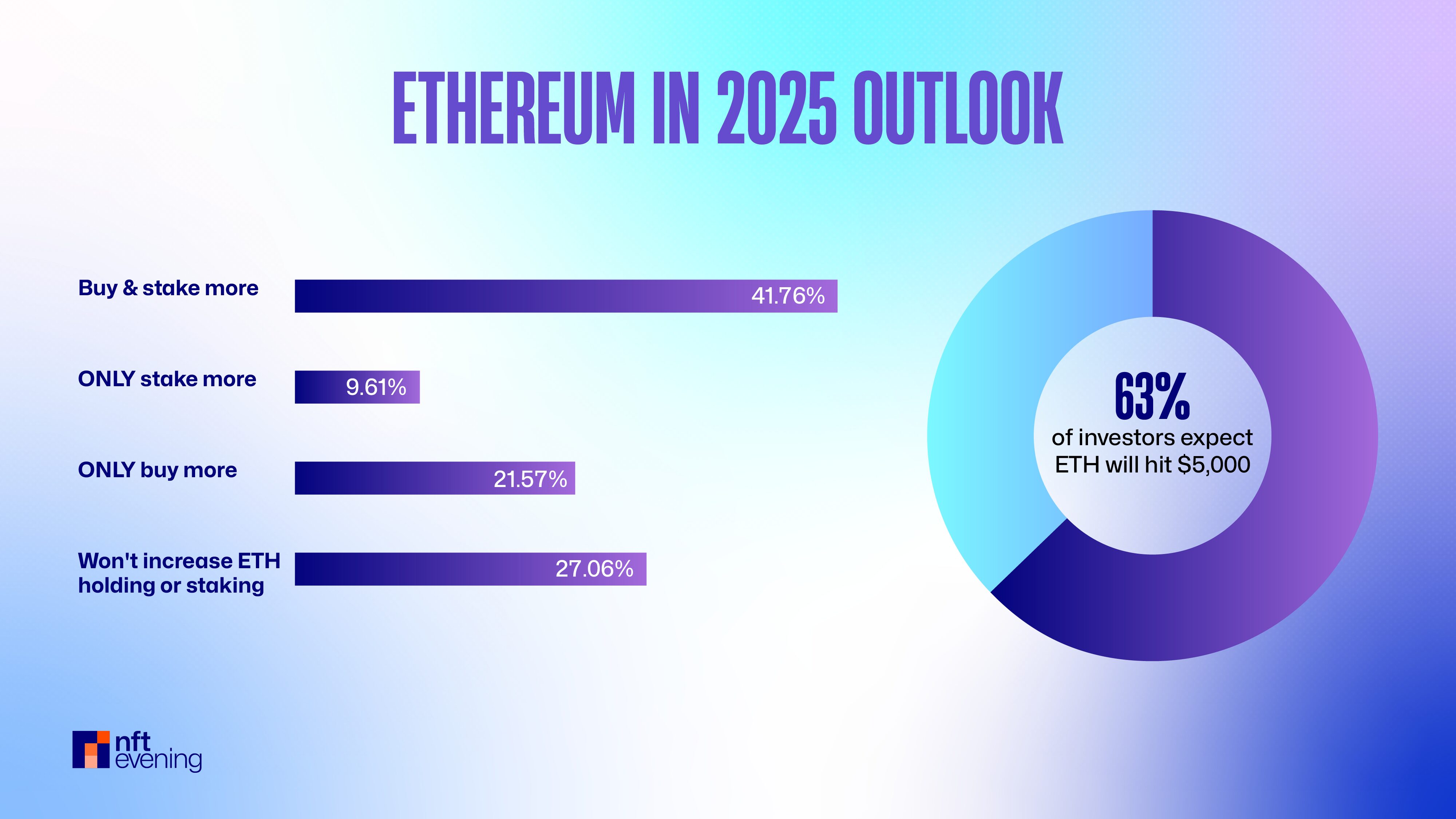

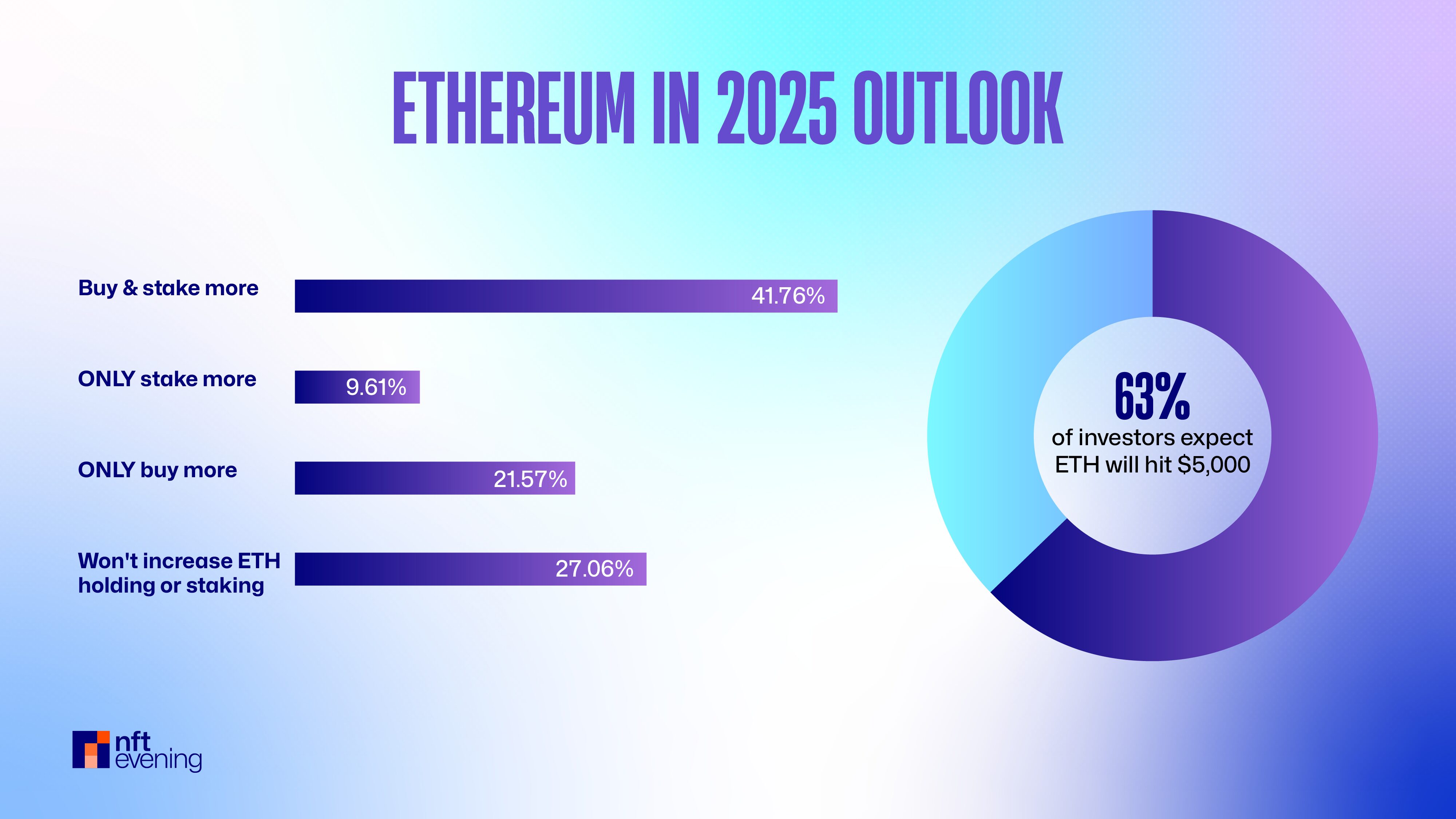

Ethereum 2025 Outlook: Will Ethereum Go Up?

Based on our data, 63% of investors believe ETH will reach $5,000 by 2025. While price predictions aren’t guarantees, this confidence level aligns with what experts are saying. Major analysts have predicted Ethereum bullish momentum driven by stronger fundamentals, not just hype.

Survey data indicates strong intentions to increase ETH exposure throughout 2025. 63% of investors plan to accumulate more ETH, while 51% intend to expand their Ethereum staking portions. This surging demand could catalyze the next major price movement, particularly if network upgrades and ETF developments align with broader market momentum.

Conclusion: The Ethereum Bull Run Is Just Getting Started

From strong portfolio allocations to sustained Ethereum holding patterns and overwhelming belief in the $5,000 price target, the sentiment is clear: Ethereum is more likely to remain bullish.

With nearly two-thirds planning to increase their ETH holdings and one-third of portfolios already committed to Ethereum, the foundation for a major rally is already in place. While macro conditions and market timing play a role, one thing stands out—ETH is far from fading. It’s preparing for another breakout year.

Methodology

The findings in this study are based on a survey of 510 crypto investors conducted via Prolific, a popular online research platform, from July 3rd to 7th, 2025. The survey examined ETH ownership, staking behavior, portfolio allocation, market sentiment, and price predictions. However, please note that the results of this survey do not represent our views or any sort of investment advice.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Chainlink

Chainlink  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  WETH

WETH  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  Ethena USDe

Ethena USDe  Zcash

Zcash  Litecoin

Litecoin  Avalanche

Avalanche  Hyperliquid

Hyperliquid  Shiba Inu

Shiba Inu  Hedera

Hedera  Canton

Canton  USDT0

USDT0  sUSDS

sUSDS  World Liberty Financial

World Liberty Financial  Dai

Dai  Toncoin

Toncoin  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Polkadot

Polkadot  Uniswap

Uniswap  USD1

USD1  Mantle

Mantle  Rain

Rain  MemeCore

MemeCore  Bittensor

Bittensor