Quick Take

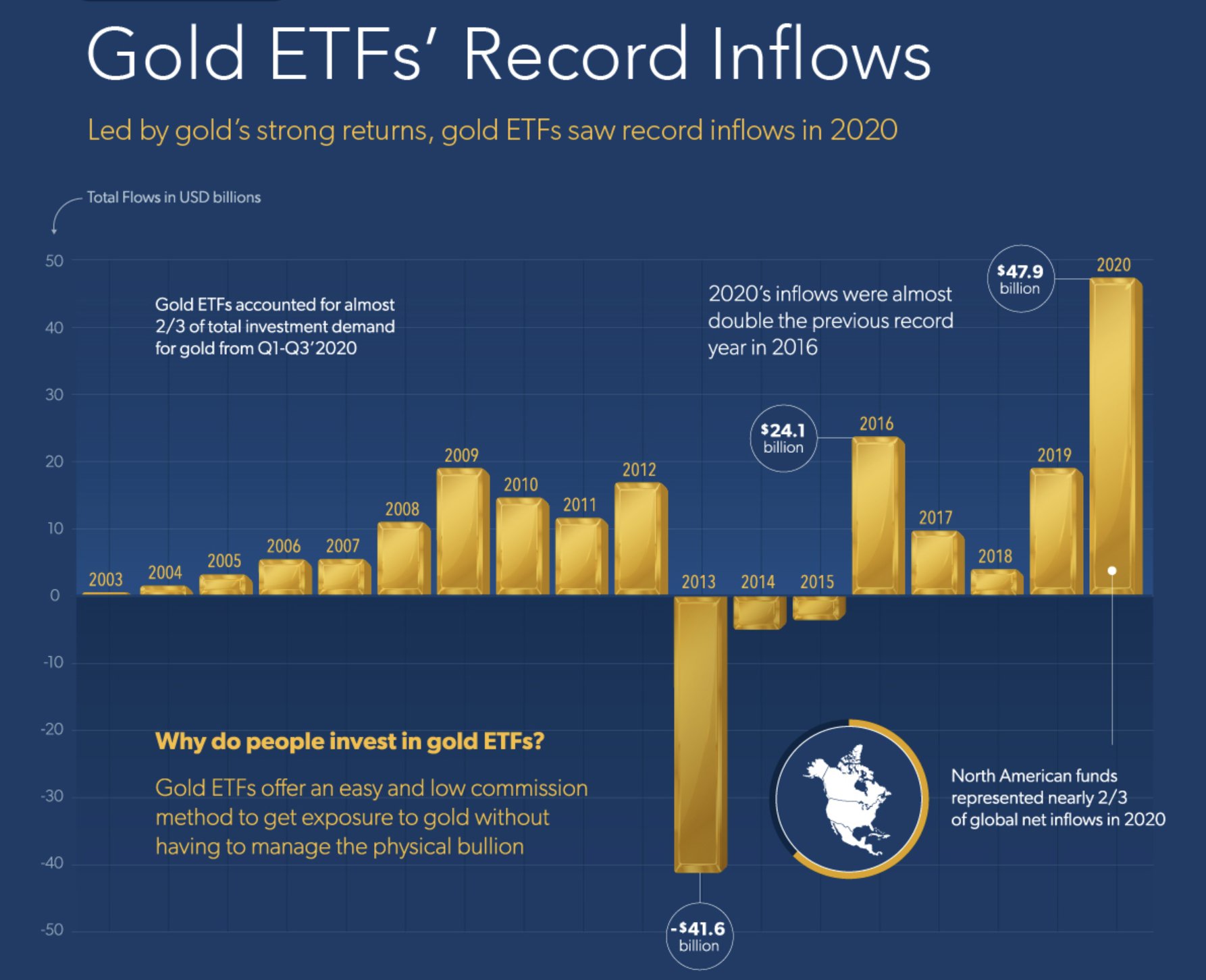

Visual Cap data shared by Matt Hougan, CIO of Bitwise, illustrates the two-decade-long journey of Gold ETFs since the first Gold ETF — GLD — launched in the US in 2004.

The data shows that between 2003 and 2012, Gold ETFs initially attracted substantial inflows due to the convenience they offered over holding physical gold. However, between 2013 and 2015, these funds experienced three consecutive years of outflows.

The trend reversed between 2016 and 2020, with five consecutive years of inflows. North America accounted for almost two-thirds of the global net inflows in 2020, according to Visual Cap.

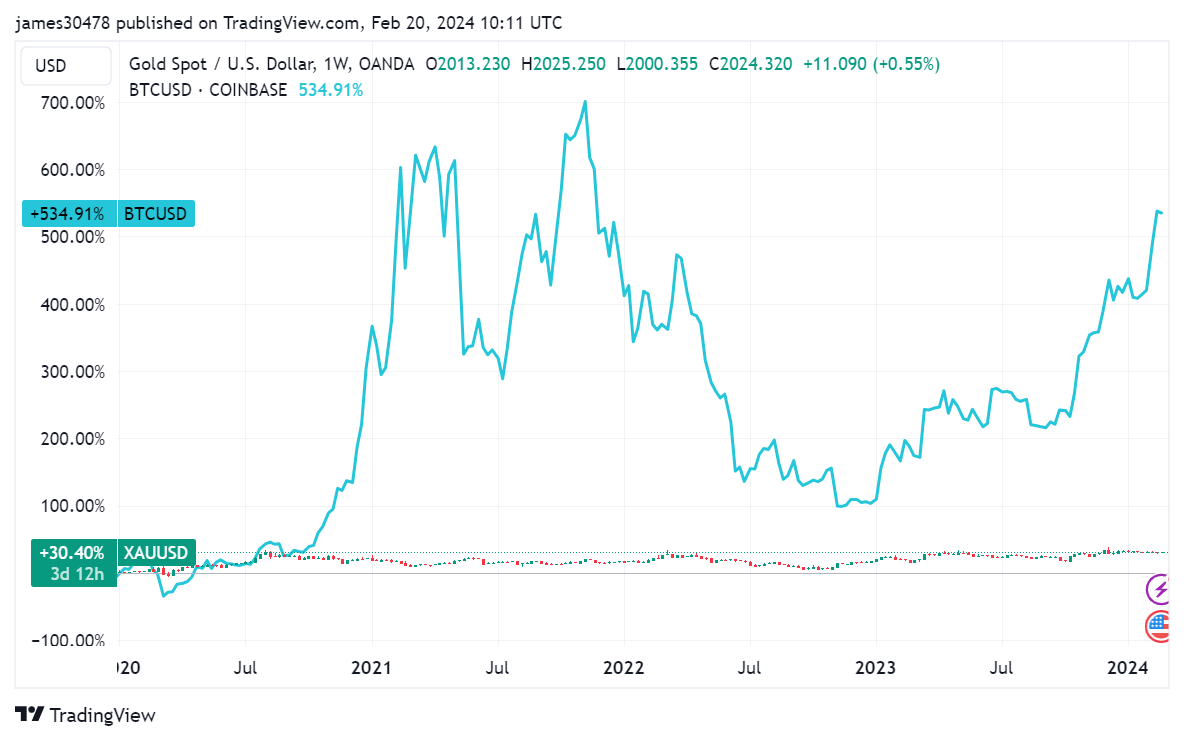

Interestingly, these significant inflows happened during the COVID-19 pandemic, a period of extreme uncertainty. Despite this, gold only saw a modest increase of 30% since the start of 2020, while Bitcoin has appreciated 535%.

In contrast, Bitcoin, often referred to as digital gold, has seen striking success since spot ETFs connected to the flagship crypto were launched five weeks ago. The ETFs have attracted approximately $4.9 billion in net inflows since they began trading.

Recently, as reported by CryptoSlate, the inflow into Bitcoin ETFs has coincided with an acceleration in the outflows from Gold ETFs, suggesting a possible shift in investors’ preferences.

The post Year 18 witnessed unprecedented record flows into gold ETFs – Matt Hougan appeared first on CryptoSlate.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  LEO Token

LEO Token  WETH

WETH  Stellar

Stellar  Sui

Sui  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Ethena USDe

Ethena USDe  Zcash

Zcash  Litecoin

Litecoin  Avalanche

Avalanche  Hyperliquid

Hyperliquid  Hedera

Hedera  Shiba Inu

Shiba Inu  Canton

Canton  USDT0

USDT0  sUSDS

sUSDS  World Liberty Financial

World Liberty Financial  Dai

Dai  Toncoin

Toncoin  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Uniswap

Uniswap  Polkadot

Polkadot  USD1

USD1  Mantle

Mantle  MemeCore

MemeCore  Rain

Rain  Bittensor

Bittensor